Let me start with a very simple question. What do you do with the vegetable you buy in bulk? Probably you put veggies in a refrigerator to protect these from the environment and use these whenever there is a need. Right?

Further Reading: What is Mutual Fund

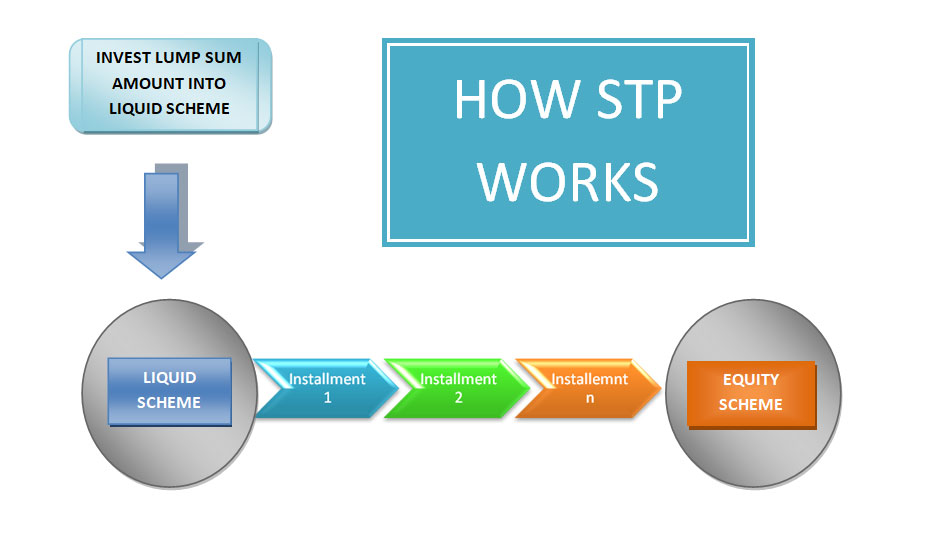

So STP is also somewhat similar to this where an individual can park his lump sum amount in a relatively safe mutual fund scheme and then transfer a certain amount of money at regular intervals into another scheme.

What is STP (Systematic Transfer Plan)?

STP is a facility which is a combination of both SIP (Systematic Investment Plan) and SWP (Systematic Withdrawal Plan) as the units are redeemed (equivalent to the STP amount) from one scheme and is invested in another. The investor will be better off if she has a lump sum amount to invest and invests it via STP route particularly in equity schemes. The investor will stand to gain better returns in a liquid scheme than her savings bank account and hence, will also be able to combat volatility of the markets.

That’s not to say that STP can only be used when you need to systematically transfer funds to an equity scheme as it can also be used the other way round.

BENEFITS OF STP

Helps You in Achieving Your Financial Goals

When you reach closer to your goals, then you are required to preserve your accumulated corpus any fall. You can choose the STP route which allows you to transfer a certain amount per month into a safe scheme, without missing returns on the whole corpus.

Better Averaging

The amount is invested in a staggered manner from one scheme to any other equity scheme. And averages your cost of buying as the NAV of the equity scheme fluctuates.

Also Read: Nominal rate Vs Real rate: Difference between nominal and real rate of return?

Reduce Volatility

As you all must know that equity markets are volatile in nature and because of which one can never time the markets. With STP, the investor will be able to mount on the volatility of the markets with ease. As a certain amount of money will be withdrawn from one scheme and will be invested in another scheme at regular intervals.

Better Returns

An investor will be able to earn extra returns if they invest via STP route. Parking of funds in a safer scheme will help you in earning better returns than the returns you earn on your savings account. However, it is only beneficial when you have a lump sum amount to invest.

Let us consider three scenarios which are generally followed by various investors.

Further Reading: Mutual Fund Sahi Hai

SCENARIO 1 – Investing lump sum in an equity scheme

An equity scheme may appear attractive to you if you will look at the returns that these schemes have generated in the past. But one must not forget the underlying risk of the equity markets. An investor putting a lump sum amount may suffer losses in the short term as it is not certain that the markets will go in which direction. For example, if you would have put a lump amount of say Rs 1,20,000 in equity mutual fund scheme in Aug 2018 then you might be suffering from losses.

SCENARIO 2 – Investing through SIPs

Suppose you are investing Rs 10,000 per month through SIP in equity-oriented mutual fund scheme. But you might not have realized that you are earning just 3% (offered by SBI on Savings Account deposits above Rs 1 lac w.e.f Aug 2019) on the amount lying in your bank account.

SCENARIO 3 – Investing through STPs

Now, consider a scenario where you are investing through STP. To bring this into effect, you will invest Rs 1,20,000 in a liquid fund on which you will earn interest between 6%-7% which is almost the double of the interest earned on a savings bank account. Then,you will transfer pre decided amount to some equity/balanced funds which will give you averaging benefits over the defined period of investments.

Hence, you can maximize your returns on the lump sum amount lying in your bank account by opting STP route. I hope, now you have got a better understanding of STP works and what are its benefits.

Keep earning high returns and achieve your goals. Happy investing…

Further Reading: Advisor Khoj