Retirement! What things come in your mind when you read or hear this word? Peace, mental stability, monthly income, vacations or maybe playing with your grandchildren.

Further Reading: Best Retirement Plans

Right? But have you ever given a thought about how would you achieve tranquillity in your golden years of life? Mind you that I am talking only in financial terms. So in order to achieve that state, you will have to plan for it well in advance.

There are basically two questions which crop up in every individual’s mind that when should they start investing and also how should they plan for their retirement. So in this blog I am going to discuss these two important aspects only.

WHEN SHOULD YOU START PLANNING FOR YOUR RETIREMENT?

The simple answer to this question would be as early as possible. The reason being that if you start investing early then your investments would have sufficient time to grow. Remember nothing big can be achieved in a short span of time. The same thing goes with your investments.

Most of you might be familiar with the compound interest. However, for the benefit of those who do not have any clue about what compound interest is, let me explain what it exactly is. So compound interest is nothing but the interest on interest you are getting on your investments and because of which compounding effect can boost your investments over a period of long term.

Also Read: How STP works and how can it benefit us during volatility in stock market?

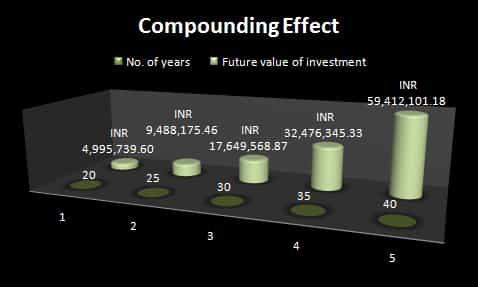

For example, if you are investing Rs. 10,000 per month at 12% p.a. return, then after 20 years, you will create a corpus of around Rs. 50 lacs but if you will increase your investment and time horizon by another 5 years, then your corpus will be doubled to Rs. 1 crore approx.

The below-mentioned chart will show you the final corpus which you can create in different time periods by investing Rs.10,000 per month at 12% p.a. rate of return.

The other advantage of investing early is that one would be able to take some extra risk. By extra risk, I mean that you would be able to invest in riskier mutual fund schemes like mid-cap or small-cap funds since they tend to outperform in the long period and you will earn higher risk-adjusted returns. Hence one can make an inference that if you start investing early then you could achieve your desired retirement corpus without any hassles.

Further Reading: Mutual Fund Sahi Hai

HOW SHOULD YOU PLAN FOR YOUR RETIREMENT?

There are a number of instruments available which usually baffles the investors as to which product they should go for or which product is right for them. Well, there is as such no single product which is suitable for every individual and in all situations.

For example, a person in his 20’s who has just started off with his career, can take exposure in risky asset classes like equities while on the other hand, a person in his 40’s cannot have the same risk capacity. That’s not to say that an individual in his 40’s cannot allocate his investments towards equity but his allocation towards risky equity schemes like small and midcap schemes should be far less than the individual in ’20s.

PRE-RETIREMENT

So, how should you proceed? Before making any kind of investments or choosing any particular financial instrument, you should always consider factors like risk appetite, risk capacity, liquidity needs, time horizon, expected returns, etc. This will help you not only in deciding the appropriate product on which you can rely but also help you in achieving the appropriate retirement corpus.

You may choose the route of mutual funds and can initiate a SIP (Systematic Investment Plan) in any of our recommended mutual fund schemes or can invest in a lump sum amount. Also, you can invest the amount lying in your bank account in any liquid fund scheme and can start STP (Systematic Transfer Plan) towards any other equity scheme.

POST-RETIREMENT

In retirement days, one can resort to SWP (Systematic Withdrawal Plan), which will ensure regular fixed amount on a fixed date as decided by you. All you need to do is to park your retirement corpus in a mutual fund scheme and initiate a SWP. One should avoid parking his retirement corpus in any midcap or small cap scheme as these are very volatile in nature and you may end up losing your entire corpus.

If you are still not sure about how should you go about this whole investment thing then you may contact our experts anytime.

Further Reading: Axis MF