Most of you have heard from your grandparents or parents saying that in our times we used to buy this particular product for such a low price or the value of Rs 100 in our times was used to be very high which is now not even close to Rs 1000.

Have you ever wondered why do they say so? Why the things which they had bought at such low prices are not available at the same prices today? What is the major factor leading to increasing the prices of products?

Don’t get baffled we are here to answer all your queries.

Further Reading: Top Five Mid Cap Funds

So, inflation is the real culprit behind all this. Some of you might have an idea about what inflation is and how it impacts us while most of the people don’t.

WHAT IS INFLATION

In simple terms, everyone defines inflation as a general rise in the prices of goods and services. We can also put it in this way, that with the passage of time the purchasing power of your money decreases.

For e.g. the things which you may buy now for Rs 1000 may not be available at the same price, 10 or 20 years down the line because of the inflation. Another example which every parent must have experienced and even experiencing is that every year the school fees of their children rises.

So inflation is the only underlying factor which is to be blamed.

HOW INFLATION IS MEASURED IN INDIA?

In India there are usually two indices which are generally used in order to measure the inflation. These are WPI (Wholesale Price Index) and CPI (Consumer Price Index). However, RBI shifted to CPI from WPI in 2014 under the governance of Sh. Raghuram Rajan for making its monetary policies.

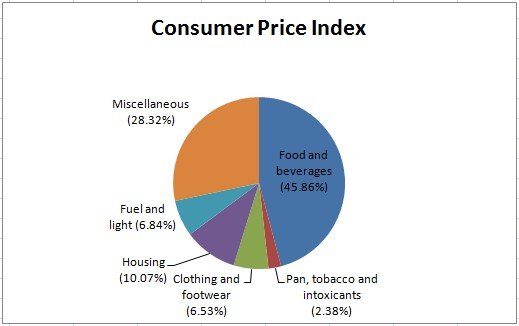

CPI – This index is basically used to measure the general rise in price level of selected goods and services that are meant for consumption by households. In other words CPI measures the change in prices by comparing the cost of fixed basket of commodities across different time periods. It usually measures inflation from the consumers’ point of view. Now, it is being used by Government of India and the Central Bank as a tool for targeting inflation and monitoring price stability.

Also Read: Don’t keep on chasing top mutual performers

The following figure shows the various components of CPI:-

Source: CENTRAL STATISTICS OFFICE

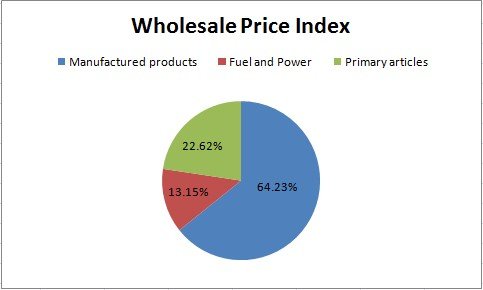

WPI – Wholesale price index on the other hand measures the change in prices of goods that are sold in bulk between entities other than the consumers. It basically measures inflation from producers’ point of view. The basket of wholesale goods is primarily divided into 3 major groups. These are – manufactured products, fuel and power, and primary articles.

Source: MINISTRY OF COMMERCE & INDUSTRY

Further Reading: Business Standard

WHAT ARE THE MAIN CAUSES OF INFLATION?

Have you ever thought of the factors that may lead to rising inflation? Well, there is not a single cause but many. These are discussed below:

-

Money supply

One may wonder how increased money supply in an economy can lead to inflation. So, if the government pumps more money into circulation then there will be a situation where the same amount of goods will be chased by more money which will lead to higher demand and eventually higher prices of goods and services.

-

National debt

As the nation’s debt increases the government is left with just two options: raising the taxes or printing more currency. So, when the government increases the corporate taxes, the companies in order to preserve their profitability pass this increase by raising the prices of their goods which ultimately leads to inflation. Secondly, when the government prints more of currency without increasing the number of goods produced, then it will lead to rise in the price of goods, thereby causing inflation.

Suppose an economy produces 10 lakh worth of goods; e.g. Rs.1 lakh goods at Rs. 10 each. At this time the money supply is Rs. 10 lakh.Now, if the government doubled the money supply, we would still have 10 lakh goods, but people have more money. Demand for goods would rise, and the firms would push up the prices.

The likely scenario will be that we will have 10 lakh of goods sold at Rs.20 each.The economy is now worth 20 lakh, rather than 10 lakh earlier but the number of goods sold will be the same. This is nothing, but inflation where there is a price rise but the quantity is the same.

-

Demand-pull effect

Another cause of rise in prices of goods is the increase in wages in the economy. Since the wage earners will now have more disposable income, they will demand more goods which would eventually lead to rise in prices. Hence the rise in demand will be offset by rising in prices.

-

Cost-push effect

In this the cost of inputs like raw materials, land, etc. increases which ultimately increases the overall cost of production. And hence the companies pass this increase to the end consumers by increasing the prices of goods, thereby protecting their profitability. For e.g. a restaurant will increase the prices on the menu if the price of the vegetable increases.

Also Read: What should be the ideal emergency corpus the individuals should maintain !

-

Change in exchange rates

We probably are not aware of the foreign currency exchange rates on a daily basis but these usually impact us. For e.g. if the Rupee gets stronger against the Dollar then the imported goods will become cheaper. As you can buy the same goods or avail same services by paying less in Rupee terms.

HOW CAN INFLATION BE GOOD FOR YOU?

There can be two scenarios where inflation is good for us. These are discussed below:-

The first scenario – Where consumer expects that the prices of goods will rise in future

This will induce them to buy that particular product now, instead of waiting for next year as they already know that the prices will increase next year.

The advantage here is that the demand is not carried forward and hence the short term demand remains intact which in turn boosts the economy.

The second scenario – Removes the risk of deflation

Deflation on the other hand is the opposite of inflation which means fall in prices of goods and services. It is even more corrosive for the economy. When the prices of goods fall, consumers wait for even more fall before buying, thereby pushing the demand. As a result of this, the companies will reduce production and lower their inventories which would lead to layoff and unemployment in the economy.

WHY ONE SHOULD NOT IGNORE INFLATION?

Most of the individuals invest their hard earned money into various investment avenues like FD, mutual funds, etc. But very of them consider inflation before investing and planning for their financial goals.

People usually get ecstatic by seeing their corpus growing, without realizing the fact. That it is just an increase in figures and in real terms not in the value of money.

Hence, it is advisable that one should consider real rate of returns rather than nominal returns on one’s investments. Now, one may be wondering what‘s the difference between real and nominal rate of return. So below is the explanation of it.

Real rate of returns are adjusted for inflation while on the other hand nominal returns are not adjusted against inflation. Hence, nominal returns are always on a higher side than the real rate of returns.

Also it is always advisable and preferred that one should plan for his goals based on the real rate of returns only.

Further Reading: Investopedia