We are pretty much sure that most of you must have listened to the name of different types of mutual funds by now. But all of you might not have an exact idea of what these are and how this works.

Further Reading: Mutual Fund Sahi Hai

So, for the sake of those individuals, we will quickly explain what mutual funds are and how many different types of mutual funds.

Mutual funds can be defined as an investment vehicle that channelizes investors’ savings in various predefined asset classes like equity shares, debt instruments or gold and distributes the returns generated from the underlying assets among the investors.

They are very flexible in nature as an investor can invest either in a lump sum amount or through SIPs (investing monthly/quarterly/half-yearly).

We usually restrain our self from investing in a new product and keep ourselves at bay. But answer one thing, how could you judge anything without even trying it?

Most of you might have a misconception that investing in mutual funds means welcoming risk, which is not true at all.

There are Different Types Of Mutual Funds schemes, which are open for subscription to all the investors which they can choose based on their risk appetite.

If you are an investor who cannot afford to take much risk then you may park your funds in safer schemes while on the other hand if you are an aggressive investor then you may invest in equity schemes and earn higher risk-adjusted returns.

So in this blog, we are going to discuss the different schemes offered by various fund houses. These schemes can be broadly categorized into equity, debt and hybrid schemes.

EQUITY SCHEMES

Most of the equity schemes are mandated to invest at least 65% of its assets in equity and equity-related instruments.

Though this percentage varies from scheme to scheme like for example ELSS and large-cap funds are required to invest 80% of their assets inequities.

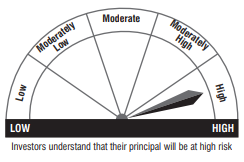

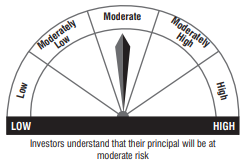

The underlying risk of these schemes on riskometer may vary from moderately high to high. There are various kinds of funds under the equity category which have been discussed below one by one.

Large Cap Fund

Large-cap funds can be considered as relatively safer schemes than the other equity schemes as these funds direct 80% of the assets in bluechip companies like Reliance, ITC, HDFC Bank, etc.

SEBI regulations have mandated these schemes to invest only in the top 100 companies (in terms of market capitalization).

These large or bluechip companies are relatively safe bets as these companies possess stable operations and have good revenue visibility. One can expect to earn returns of around 12% out of these schemes.

Mid Cap Fund

These funds invest in those companies which are on a growth trajectory and have proved themselves as successful enterprises.

As per SEBI mandate these funds have to invest only in those companies which fall in between 101th – 250th based on the market cap.

These funds direct a minimum of 65% of the assets under management towards mid-cap companies only. One can expect to earn returns of around 15% of these schemes.

Small-Cap Funds

Small-cap schemes are the riskiest one than the above two as these schemes invest 65% of its assets in small-cap companies.

These schemes should only be looked at by aggressive investors who can bear the volatility of these funds. These schemes are able to generate astonishing returns of around 18% or more in the long term as these schemes have a much wider universe of companies to choose from.

As per SEBI regulations, these funds can invest in the rest of the companies (251st onwards in terms of full market capitalization).

ELSS

Equity-linked savings schemes or ELSS also invests 80% of the total assets in equity and equity-related instruments.

The regulations do not mention whether the assets have to be allocated in large-cap companies or mid or small companies.

Hence these funds are free to invest in the whole equity universe. Also, investments in these funds qualify for tax deduction up to 1.5 lacs under section 80C of the Income Tax Act, 1961.

These schemes come with a lock-in period of 3 years which is, however, the lowest among any other tax saving instrument.

Multi-Cap Fund

Multi cap schemes are the diversified funds which invest in a mix of large-cap, mid-cap and small-cap stocks. These funds provide flexibility to the fund managers as they can change the asset allocation as per the market conditions.

These funds are required to invest a minimum of 65% of the assets in equity and equity-related instruments.

Large & Mid Cap Fund

These schemes invest in both large and mid-cap companies. The minimum investment in each of these categories is set at 35% of the total assets.

The idea of proposing these schemes is to provide the dual benefit of high return of mid-cap stocks and safety of large-cap stocks to the investors in one scheme.

Also Read: SECTION 54 EC – Invest your capital gains in capital gain bonds

Dividend Yield Fund

These schemes predominantly invest 65% of the total assets in listed entities which declare high dividends.

The main focus of these schemes is on generating income for the investor through dividends along with the capital appreciation in the stock prices.

Value Fund/ Contra fund**

This category of mutual funds follows a particular strategy for the selection of stocks and directs at least 65% of the scheme’s assets towards such stocks.

Value funds follow a strategy called value investing whereas contra funds take contrarian bets for picking stocks.

For example, value funds will pick only those stocks which are available at a discount while contra funds will invest in only those sectors or stocks which are currently distressed.

** AMCs will be permitted to offer either a value fund or contra fund.

Focused Fund

These are the open-ended schemes which define the maximum number of stocks in which the fund will take an exposure.

The maximum number of stocks a fund in this category can hold is capped at 30. Like other equity schemes, this fund also has to invest at least 65% of the assets in equity and equity-related instruments.

Sectoral / Thematic Fund

These funds have to invest at least 80% of the total asset in a particular sector for which the scheme has been floated. These are the riskiest funds and should only be looked at by those investors who can keep up with the volatility.

| SCHEME NAME | TIME HORIZON | RISKOMETER |

| Large Cap Fund | Minimum of 3 years |  |

| Mid Cap Fund | 5 – 7 years+ |  |

| Small Cap Fund | 7 years+ |  |

| Focused Fund | Minimum 5 years |  |

| Value Fund/ Contra fund | Minimum 5 years |  |

| Dividend Yield Fund | Minimum 5 years |  |

| Large & Mid Cap Fund | Minimum 5 years |  |

| Multi Cap Fund | Minimum 5 years |  |

| Sectoral / Thematic Fund | Minimum 5 years |  |

DEBT SCHEMES

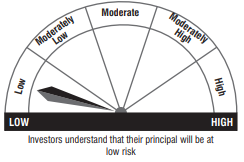

The investors who cannot stomach the volatility of the equity markets and are looking for generating some stable income can look to invest in debt schemes.

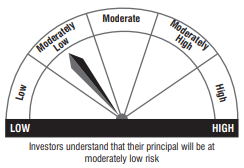

The risk grade of debt schemes may vary from low to moderate. Debt schemes generally invest in money market instruments, corporate bonds, and government securities.

An investor should even choose debt schemes wisely based on his/her liquidity needs, risk appetite and time horizon as in the absence of due consideration you might get stuck with a scheme which is not suitable for you.

Overnight Fund

These funds invest in those debt securities having a maturity of only 1 day. The funds are reinvested every other day in other debt securities.

This is the recent most category which was introduced by the SEBI and has been placed above liquid funds in terms of risk. Parked funds can be withdrawn the very next day and even without any exit load.

Liquid Fund

Liquid funds invest in debt and money market securities having a maturity of up to 91 days. Recently a graded exit load has been imposed on withdrawals up to 7 days.

Also, recent changes in the regulation of these funds have made them more transparent and a little volatile. One can compare the returns of liquid funds with that of interest on the savings account.

Ultra Short Duration Fund

These funds invest in debt and money market instruments such that the Macaulay duration* of the whole portfolio remains in between 3-6 months.

Low Duration Fund

These funds invest in debt and money market instruments such that the Macaulay duration* of the whole portfolio remains in between 6-12 months.

Money Market Fund

These open-ended schemes invest in money market instruments having the maturity of up to 1 year. These schemes generally have a moderately low risk.

Short Duration Fund

Short duration funds invest in such a manner that the Macaulay duration* of the portfolio remains in between 1 year – 3 years and also these funds invest only in debt and money market instruments.

Medium Duration Fund

These funds invest in debt and money market instruments such that the Macaulay duration* of the overall portfolio is between 3-4 years. These funds can be more volatile than any of the above-mentioned categories.

Medium to Long Duration Fund

These funds invest in debt and money market instruments such that the Macaulay duration* of the overall portfolio remains in between 4-7 years.

Long Duration Fund

Long duration funds hold long term debt and money market instruments. These funds are required to keep the Macaulay duration* of the portfolio above 7 years.

Dynamic Bond

These open-ended mutual fund schemes can invest in debt instruments across all durations. The fund manager can modify the duration based on his call on market interest rates.

Corporate Bond Fund

The corporate bond schemes invest at least 80% of the scheme’s assets in bonds issued by corporate. The assets must be invested in the highest-rated instruments only.

Credit Risk Fund

Credit risk funds usually bet on fairly ranked instruments. These schemes need to invest 65% of the total assets in corporate bonds which are not among the highest-rated instruments.

Banking and PSU Fund

These bonds can also be considered as quasi-sovereign bonds as these schemes invest 80% of total assets in debt instruments issued by banks, public sector undertakings and public financial institutions.

Gilt Fund

Gilt funds invest 80% of the assets of the scheme in the government securities or G-secs across different maturities.

Also Read: Does mutual funds offer the scheme of my choice? A detailed overview of all schemes offered by mutual funds

Floater Fund

These funds invest 65% of the assets in instruments bearing floating or variable rate of interest. The interest payable on these underlying bonds fluctuates with the underlying interest rate level.

*MACAULAY DURATION – It is the weighted average time period over which the cash flows from the various bond holdings are received:

| SCHEME NAME | TIME HORIZON | RISKOMETER |

| Overnight Fund | Investment can be made even for 1 day |  |

| Liquid Fund | Investment to be made for at least 7 days to avoid any exit load |  |

| Ultra Short Duration Fund | 3-6 months |  |

| Low Duration Fund | 6-12 months |  |

| Money Market Fund | Up to 1 year |  |

| Short Duration Fund | 1-3 years |  |

| Corporate Bond Fund | 3 years |  |

| Floater Fund | 1 years |  |

| Medium to Long Duration Fund | 4-7 years |  |

| Long Duration Fund | 7 years + |  |

| Dynamic Bond | 3 years |  |

| Medium Duration Fund | 3-4 years |  |

| Credit Risk Fund | 3 years |  |

| Banking and PSU Fund | 3 years |  |

| Gilt Fund | 7 years |  |

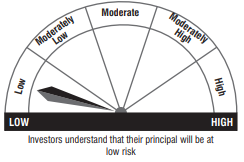

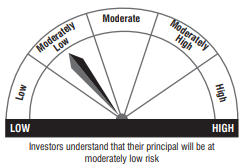

HYBRID SCHEMES

Hybrid schemes usually invest in a mix of asset classes like debt, equity and gold ETFs. These schemes may be suitable for those individuals who want to take exposure in multiple asset classes simultaneously. These schemes have also been categorized based on the allocation in different asset classes.

Conservative Hybrid Fund

These funds invest in a mix of equity and debt instruments. However, these schemes invest predominantly in only debt instruments.

The investment in equity and equity-related instruments may vary from 10% to 25% while investment in debt instruments varies from 75% to 90% of the total assets.

Balanced/ Aggressive Hybrid Fund**

These funds direct most of the scheme’s assets towards equity and equity-related instruments. As per SEBI regulations, balanced funds should invest in debt and equity in the proportion of 40%-60% each. While in case aggressive hybrid funds the allocation inequity should be in between 65%-80% while in debt instruments it should be in between 20% to 35%.

Remember balanced funds will not be treated as equity funds for tax treatment because the maximum allocation in these funds is capped at 60% (required 65%) whereas aggressive funds will be treated as equity funds for tax treatment.

** AMCs are permitted to offer either a balanced fund or an aggressive fund.

Dynamic Asset Allocation or Balanced Advantage

While the above two have to mandatorily invest as per the limits prescribed by SEBI but there are no limits defined for this particular scheme.

This enables a fund manager to take exposure from 0% to 100% in any of the asset class i.e. debt or equity. But these schemes usually maintain their exposure in equities at 65% through arbitrage and hence qualify for the tax treatment similar to that of equity schemes.

Multi-Asset Allocation

Multi-asset allocation funds need to invest in a minimum of three asset classes. The minimum exposure in any of these asset classes should be at least 10% of the total assets. These funds usually invest in debt, equity and gold ETF’s.

Arbitrage Fund

Arbitrage funds are those funds which look for opportunities of price differences in two markets and exploit them in order to earn returns.

These funds have to direct 65% of the assets towards equity and equity-related instruments but still, these funds are relatively safer bets as these funds lock into the spread and generate returns.

One can expect to earn around 7%, along with the benefit of the tax treatment of equity funds.

Further Reading: Money Control

Equity Savings

This open-ended scheme invests in a mix of both debt and equity instruments with a minimum investment at 10% and 65% respectively and also follows the arbitrage strategy to generate steady returns for the investors.

| SCHEME NAME | SUITABILITY | RISKOMETER |

| Conservative Hybrid Fund | 3 years |  |

| Balanced/ Aggressive Hybrid Fund | 3 years |  |

| Dynamic Asset Allocation or Balanced Advantage | 3 years |  |

| Equity Savings | 3 years |  |

| Multi Asset Allocation | 3 years |  |

| Arbitrage Fund | 3 years |  |

CONCLUSION

So, as you have seen that the universe of mutual funds schemes is too big and there are plenty of options available for the investors to choose from. An investor can opt for any of these schemes based on his/her risk appetite, time horizon and goals.

For example, if an investor can keep up with the volatility of the equity markets then he/she may pick equity schemes while if the investors’ main objective is the protection of capital then he/she may park their funds in overnight or liquid funds.