Simply put, the nominal rate of return is the return which an investor earns on his/her investments. While on the other hand real rate of return is the return which is adjusted for inflation.

Further Reading: Mutual Fund Sahi hai

The real rate of return exhibits true picture to the investors simply because it accounts for inflation.

The value of money descends over a period of time and hence inflation should be taken into consideration inevitably while planning for investments.

WHY REAL RATE OF RETURN

Consider a situation where you want to buy a car after 5 years costing ₹10,00,000 in present terms and decided to invest based on that current price only. But after 5 years will the cost of that car will be the same? The answer is a big no (ignore exceptions that might arise due to slowing economy).

The price of that car will be definitely on a higher side at any future date due to the inflation. Let’s say for example, the return you are getting on your investments is 12% and the price of that car is expected to rise by 8% every year.

So effectively you are earning only 4% (12%-8%) on your investments as most part of your return is getting set off by inflation.

In other words, your purchasing power is only increasing by just 4%. Henceforth, instead of taking nominal return, one should consider the only the real rate of return to get a true picture.

REAL RATE OF RETURN ON FD’s

Most of the investors look only for nominal returns that they are getting on their investments and not the real returns, which actually they should look for before making any investment.

Let us consider the example of the most popular financial instrument among investors of all ages i.e. fixed deposit (FD).

If you will consider only nominal returns on your FDs then you will definitely find a rise in the absolute value of your investments, but is this increase in amount affects your future purchasing power? Probably not.

Also Read: Sovereign Gold Bond: What is it? A complete overview

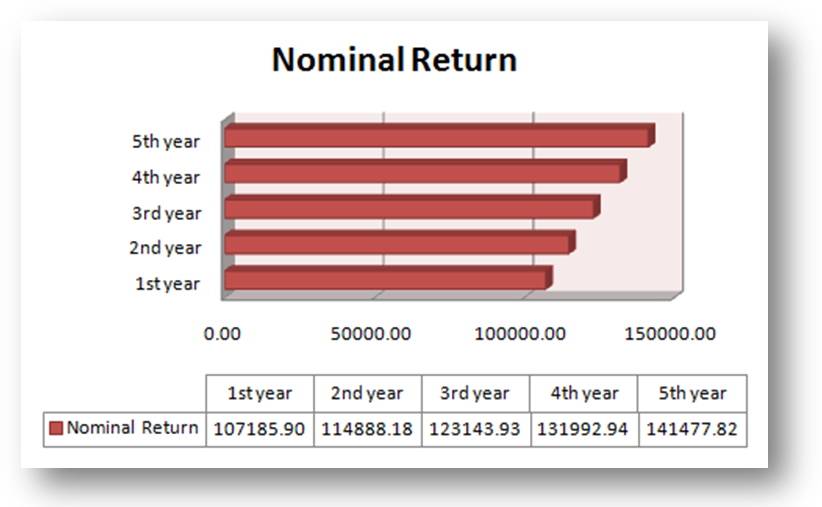

Suppose you have invested ₹1,00,000 in a 5 year FD which is yielding 7%. So after 5 years the investment value will rose to ₹1,41,477. An increase of ₹41,477 over 5 years, satisfied? Many of you would be, but it is only a mirage. Now let us look at a true picture of it.

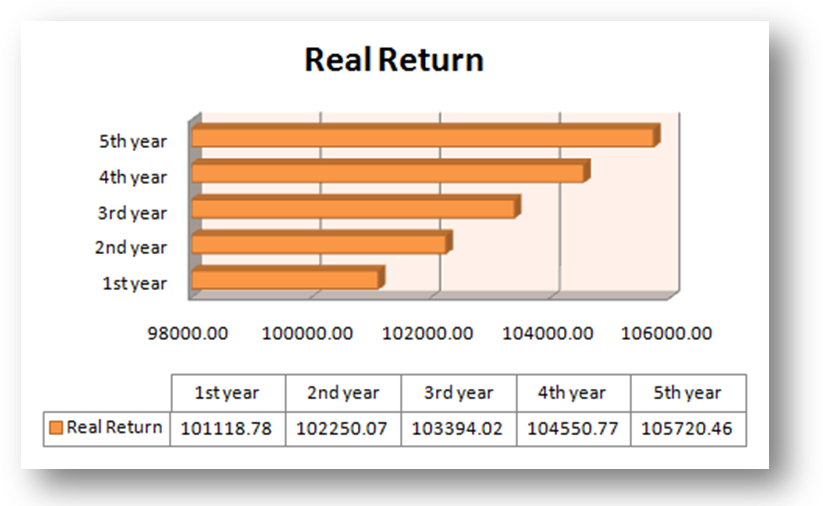

Now consider inflation @6% and take real rate of return {1.11% (1.0718/1.06)-1} then the value of your investments would only be ₹1,05,720 after 5 years, which in turn means a rise of only ₹5,720.

Well this time most of you would not be satisfied with the returns but it is the real purchasing value of your overall investments.

NOTE: – FD returns are compounded on a quarterly basis hence for calculation we have converted nominal returns into effective returns. The effective return is nothing but the annual returns achieved after considering multiple compounding.

CONCLUSION

Nominal return is always on a greater side than the real rate of return and hence, we get a higher future value of our investments. But in order to get a fair reflection of your investment value, the investor should always ponder upon real return as it offers a better measure of investment performance. Inflation is not only the sole factor for this but our lifestyles and demand also keeps on changing or rather increases with the increase in the income which necessitates the use of real return. The real return will only help the investors in identifying the real value of their money which is adjusted for inflation.

Further Reading: Mutual Fund Sahi Hai