Taxpayers often look for ways to reduce their tax liabilities. Income Tax Act, 1961 has provided enough room to taxpayers to reduce their tax liabilities under various sections.

Further Reading: What is Mutual Fund

One such section is Section 54EC. Under this section, an individual can claim an exemption on long term capital gains on the transfer of capital assets like land and building or both. To avail the exemption under this section, an individual is required to invest capital gains in capital gain bonds.

In this blog, we are going to discuss whether you should invest capital gains in capital gain bonds to save taxes or should invest the net amount in mutual funds after paying taxes.

Suppose a house property has been transferred in FY 2019-2020 and capital gains on the transfer are worth Rs. 30 lakhs (after indexation). The following 3 cases have been taken into consideration for the purpose of analysis.

|

Case 1 |

Entire capital Gain is invested in capital gain bonds |

|

Case 2 |

Tax on capital gain is paid and the rest is invested in equity |

|

Case 3 |

Tax on capital gain is paid and the rest is invested in debt |

In all the cases, we have found out the probable savings of the investor after 5 years as the lock-in period of capital gain bonds is 5 years.

Case 1

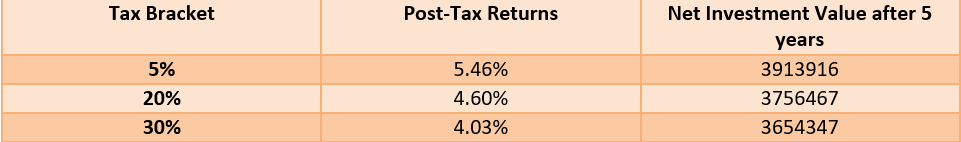

The first option available to an investor is to invest capital gains from the transfer of assets in capital gain bonds. Since the interest received from these bonds is taxable in the hands of investors, we have taken post-tax returns for individuals in all tax brackets. Remember that an individual is allowed to invest a maximum sum of Rs. 50 lakhs in these bonds in a financial year.

Case 2

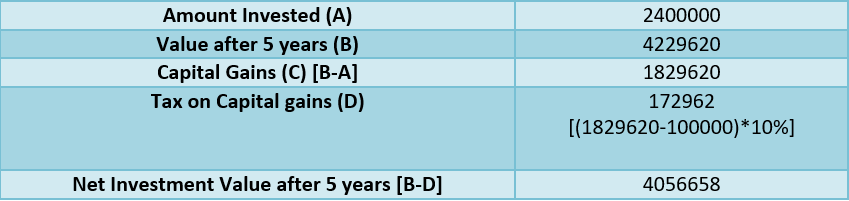

Another option available with the investor is to invest capital gains in equity oriented mutual funds after paying taxes. Capital gains from sale of land and building are taxed at a flat rate of 20% with indexation. So, if we calculate tax on capital gains of Rs. 30 lakh then it will come out to be around Rs. 6 lakh. The balance amount i.e. Rs. 24 lakhs can be invested in mutual funds. If the investment is expected to generate 12% CAGR then the net savings will be as follows –

Capital gains from equity mutual fund units are taxed at a flat rate of 10% on capital gains exceeding Rs. 1 lakh. After adjusting investment value (after 5 years) with net taxes to be paid on this gain, we get the final investment value as Rs. 40.56 lakhs.

Also Read: Invest Money or Not – What are the benefits of starting early?

Case 3

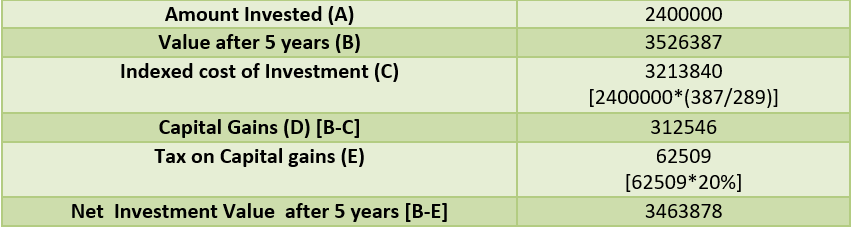

Another option with the people is to invest capital gains from sale proceeds in debt-oriented mutual funds. Capital gains from debt mutual funds are taxed at a flat rate of 20% after indexation. In our example, we have assumed that the investment has been made in the financial year 2019-2020 and redeemed in the financial year 2024-2025. Cost inflation index figure for the FY 2019-20 is available while the figure for FY 2024-2025 has been calculated by assuming an inflation rate of 6%. If the expected returns from debt mutual fund is around 8% p.a. then the investment value after 5 years, in this case, would be –

Conclusion

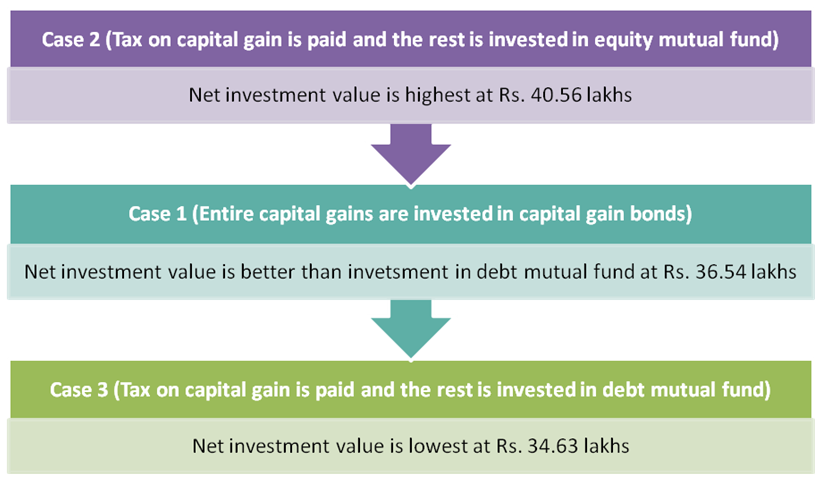

If you will have a look at the net investment value after 5 years of all the above cases then you will find that the person would be better off if he invests capital gains in equity-oriented mutual funds post payment of taxes. However, one should look at his own risk profile before going for this option as equity investments are volatile in nature and one should examine that whether they would be able to stomach the volatility of equity markets or not. Don’t take too aggressive bets when investing in equity schemes for 5 years. Stick to large-cap schemes only as 5 years is a good amount of time to expect decent returns from these schemes.

Further Reading: Financial Express