NPS or National Pension Scheme is an old age security scheme which was launched by Government of India on 1st January, 2004. The scheme replaced the previously existing pension model which provides fixed pension to the employees based on their salary.

Further Reading: Best Pension Plans

However, this new pension model is built on the concept of voluntary defined contribution wherein the pension amount will be decided based on the accumulated corpus at retirement. The scheme was open for subscription for the general public on 1st May, 2009. This allows every Indian citizen to effectively plan their retirement based on their risk appetite at a minimal cost.

PFRDA (Pension Fund Regulatory and Development Authority) is the regulator of NPS, which also appoints and regulates the PFM (Pension Fund Manager). Currently, there are 8 pension fund managers authorized by PFRDA, but however, only three among them are allowed to manage funds for both, the government and the private sector. This PFM are:-

- LIC Pension Fund Ltd. (both)

- SBI Pension Funds Pvt. Ltd. (both)

- UTI Retirement Solutions Ltd. (both)

- Birla Sun Life Pension Management Ltd.

- HDFC Pension Management Co. Ltd.

- ICICI Prudential Pension Fund Management Co. Ltd.

- Kotak Mahindra Pension Fund Ltd.

BENEFITS OF NATIONAL PENSION SCHEME

-

Low Cost

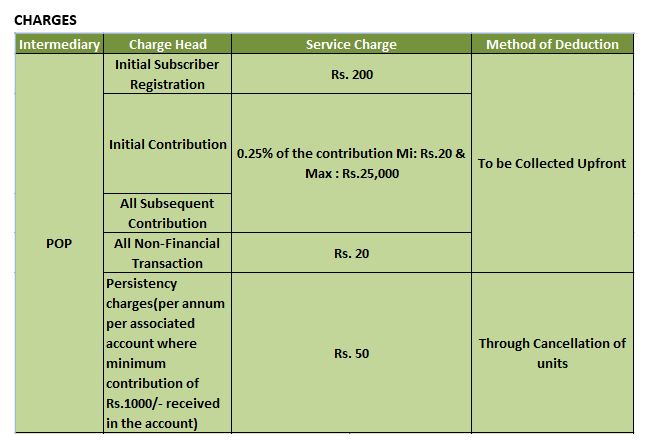

NPS is considered as the low cost pension scheme in comparison to those offered by insurance company and mutual fund schemes. The fund management charge is just 0.01% which is probably the lowest across any investment instrument; however, it is not the only charge which is to be paid.

-

Portable

NPS is portable in the sense that a subscriber can invest through any of the POP-SPs branch or can also make contributions through eNPS i.e. online. Hence, a subscriber can operate his NPS account throughout the country without any hassle. Also, there is a provision of shifting NPS account to any other sector like from government sector model to private sector model and vice versa.

-

Simple

To get started with investing in NPS, one has to open an account with any of the nearby POPs (point of presence) or can even open an account through eNPS by submitting the required documents.

-

Voluntary Investment

An investor can change the contribution and can contribute it at any point in time during a financial year. However, one must remember that he has to contribute at least Rs 1000 in every financial year towards Tier I account while no minimum balance is to be maintained for Tier II account except for the initial contribution which is to be made at the time of registration.

-

Flexible investment options

NPS offers a lot of investment option to its subscriber. The subscribers can choose among two available choices – Active choice or Auto choice. Apart from this, they can choose pension fund managers on their own and can switch their investments from one pension fund to another or one scheme to another.

Also Read: Loan or invest – Should you prepay your loan first or invest?

ENTITIES RELATED TO NATIONAL PENSION SCHEME

There are several intermediaries which perform various kinds of functions and ensure smooth functioning of the NPS scheme.

-

Annuity Service Provider

ASP or Annuity Service Provider is appointed by the PFRDA who is responsible for providing monthly pension to the NPS subscriber. The ASP aims to provide regular pension through their various schemes. An individual is required to purchase one annuity scheme from any of the ASP of his choice.

Currently there are only 5 ASPs appointed by PFRDA. These are:-

- Life Insurance Corporation of India

- HDFC Life Insurance Co. Ltd.

- ICICI Prudential Life Insurance Co. Ltd.

- SBI Life Insurance Co Ltd

- Star Union Dai-Ichi Life Insurance Co Ltd

-

Pension Fund Manager

These are the fund management companies who are appointed by PFRDA; and perform the duty of managing the subscriber’s funds.

-

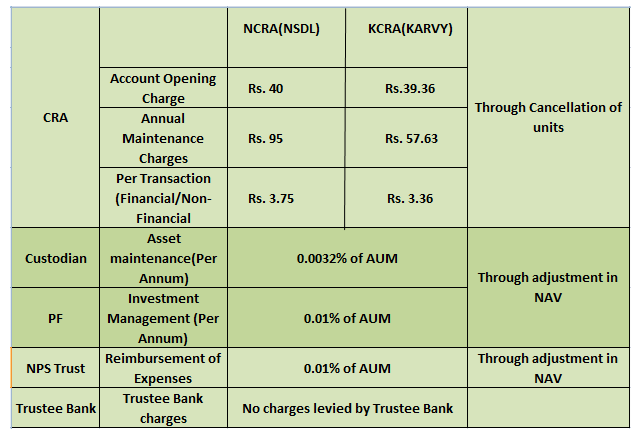

Central Record Keeping Agency (CRA)

CRA is concerned with the maintaining of records of the NPS subscriber and it is also appointed by the regulator i.e. PFRDA.

-

POP and POP-SP

POPs or Point of Presence are mainly commercial banks who act as the first point of interaction with the NPS subscribers and are appointed by PFRDA. The authorized branches of these POPs are called POP-SPs which are responsible for providing service to the customer and also act as collection point.

-

NPS Trust and Trustee Bank

The NPS trust is responsible for managing the funds under NPS and the bank with whom Trust holds a bank account is known as Trustee Bank. Based on the instructions received from CRA, the trustee bank transfers the funds.

HOW TO OPEN NATIONAL PENSION SCHEME ACCOUNT AND ITS ELIGIBILITY

Any Indian citizen between 18-65 years of age can apply for NPS account either by visiting nearby POP-SP or through eNPS website directly. A unique PRAN (Permanent Retirement Account Number) is generated and allotted to each NPS subscriber. Once an account is opened, you will have to make an initial contribution which is minimum Rs 500 for Tier I account and minimum Rs 1000 for Tier II account.

Even NRIs between the age brackets of 18-60 years can also open an NPS account. Also, the scheme is also made available to poor people and people in the unorganized sector through Atal Pension Yojana.

TYPES OF NATIONAL PENSION SCHEME ACCOUNT

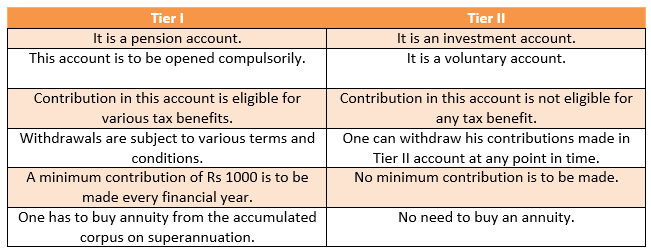

There are two types of account which can be opened by an individual – Tier I and Tier II. Among these two Tier, I account is compulsory while the other is optional.

Further Reading: NPSCRA.NSDL

INVESTMENT CHOICES

NPS provides its investors several investment options to choose from. There are mainly two broad options – Auto choice and Active choice. If the subscriber does not choose any of these, then the subscriber’s money will be invested as per the default choice – Moderate Life Cycle Fund under Auto choice.

AUTO CHOICE (LIFECYCLE FUND)

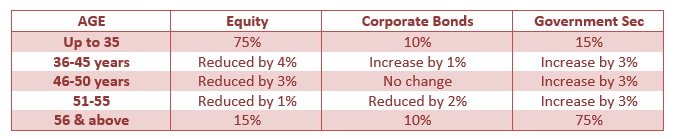

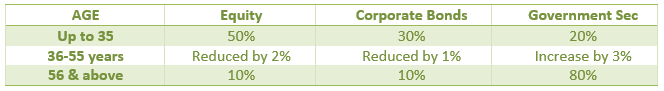

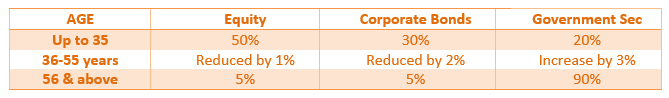

Individuals who do not have any knowledge about how much should they allocate in each asset class and want to be free from all the hassles may choose this option. Under auto choice, the funds are invested in a lifecycle fund wherein the funds are invested across various asset classes (E, C or G) based on the chosen lifecycle and the age of the subscriber. There are three types of lifecycle funds which are made available to the NPS account holders. These are:-

-

LC 75 (Aggressive Life Cycle Fund)

75% of the funds are invested in equities till 35 years of age which is gradually reduced every year with the age of the subscriber.

-

LC 50 (Moderate Life Cycle Fund)

50% of the funds are invested in equities till 35 years of age which is gradually reduced every year with the age of the subscriber.

LC 25 (Conservative Life Cycle Fund)

25% of the funds are invested in equities till 35 years of age which is gradually reduced every year with the age of the subscriber.

ACTIVE CHOICE (INDIVIDUAL FUNDS)

Under the active choice, the subscriber gets 4 investment options – Equity (E), Corporate bonds (C) , Government securities (G) and alternative investments (A). The subscriber has full freedom to choose his asset allocation on his own. The subscriber can allocate his entire contribution towards C or G category, however, there are some restrictions for E category which is explained below:-

- A subscriber is allowed to put maximum of 75% of the funds in equity till 50 years age.

- The exposure will then have to be reduced by 2.5% every year till 60 years age.

- After 60 years of age, exposure in equity is capped at 50%.

TAXATION BENEFITS

-

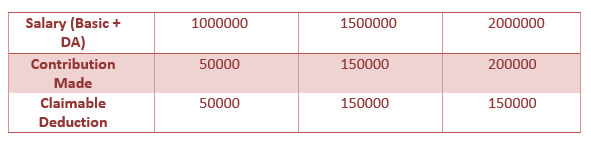

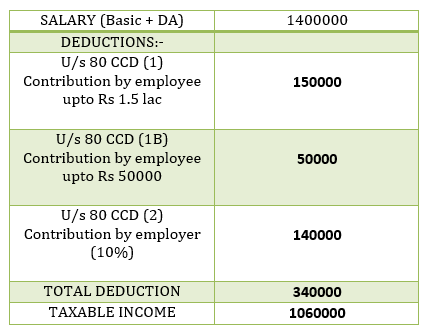

Under Sec 80 CCD (1)

Any salaried individual who is a subscriber of NPS can claim tax deduction up to 10% of gross income under Sec 80 CCD (1) with in the overall ceiling of Rs. 1.5 lac under Sec 80 CCE.

-

Under Section 80CCD (1B)

All NPS subscribers are eligible for deduction up to Rs 50000 for the contribution made towards Tier I account. This deduction is over and above the ceiling of 1.5 lacs. Hence an individual would be able to claim deduction up to Rs 2 lacs in total by investing in NPS.

-

Under Section 80 CCD (2)

This section provides an additional deduction to the subscribers under the corporate sector. Under this, the contribution made by an employer up to 10% of the employee’s salary is eligible for claiming tax deduction, without any upward limit. This does not come under the purview of 80 CCE which restricts the maximum deduction at 1.5 lacs.

As we can see that investment in NPS offers various tax incentives to its subscriber which makes it the best instrument for saving tax.

Also Read: Credit Card Limit – How Issuing Companies Determine Your Credit Card Limit

WITHDRAWAL/EXIT POLICY FOR NATIONAL PENSION SCHEME

1. Upon Superannuation

On attaining 60 years of age, i.e. on maturity, the subscriber can withdraw up to 60% of the accumulated corpus in lump sum amount while the rest 40% has to be utilized for purchasing an annuity to receive monthly pension. The 60% corpus that can be withdrawn in lump sum has recently been made tax free while one has to pay tax on the pension to be received from the annuity.

Also, if the total value of the corpus on maturity is less than or equal to Rs 200000 then the subscriber is allowed to withdraw 100% of the corpus in lump sum.

2. Partial Withdrawal

NPS allows for partial withdrawals in case of certain cases like higher education of children, children marriage, treatment of critical illnesses and construction/purchase of residential house. However, partial withdrawals are allowed only after 3 years of continuity and are capped at 25% of the contributions made by the subscriber. The withdrawn amount is tax exempted. Also, one is allowed to withdraw an amount only thrice in the entire tenure.

3. Pre- mature exit

NPS provides an option of pre-mature exit only after the completion of 10 years. The investor has to purchase an annuity for at least 80% of the value of the corpus in order to receive pension while the left amount can be withdrawn in lump sum which is 20%.

The amount withdrawn in lump sum is tax free, however, the income from annuity will be taxable in the hands of the subscriber as per one’s tax slab.

The subscriber is allowed to withdraw the whole corpus in lump sum if the value is less than or equal to Rs 100000.

4. Upon death of the subscriber

In case of unfortunate death of the NPS subscriber, the whole corpus can be withdrawn in lump sum. The entire corpus will be paid to the nominee or legal heir of the subscriber and is exempted from tax.

Further Reading: PFRDA