We face so many confusions to opt one option between Prepay our loan or invest our money… But from today we all able to choose the right option:

Further Reading: Mutual Fund Sahi Hai

People who have taken home loans or loan of any other kind must have once encountered a problem that whether they should prepay their loans with the surplus amount they have got or should they continue with the EMIs and invest this surplus amount in mutual funds.

Making a decision regarding prepaying one’s home loan is more difficult than the decision of prepaying or foreclosure of any other loan because in case of home loan you are also eligible to avail tax deductions on the interest payment as well as on the principal repayment under section 24 and section 80 C respectively.

In this blog, we are going to reduce some complexities for you and will make you more capable of making an informed decision for yourself on your own.

Understanding your loan

Whenever you take any loan you pay EMIs (Equated Monthly Instalment) on it. There are two components of any EMI – interest payment and principal repayment. The interest component represents a major part of your EMIs in the initial repayment years.

As you progress with the repayment of your loan the interest component diminishes and the principal component goes on increasing.

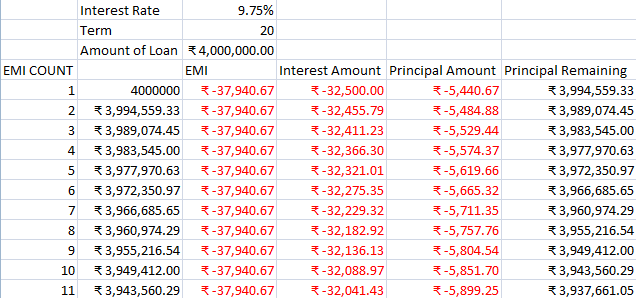

Following is an attempt to make the readers understand the components of their EMIs.

For this, we have considered a loan of 40 lacs taken for 20 years tenure at an interest rate of 9.75% p.a. (monthly reducing).

On having a look at the above image, you will easily understand the proportion of both the components in your EMIs in the initial years. As said earlier, the interest component is decreasing and the principal amount is increasing with each EMI you repay.

What if you pre-pay a part of your loan…How much will you save

If any borrower chooses to pre-pay a part of his loan then he may either opt for reducing his EMIs or reducing the tenure of the loan by keeping the EMIs same. For example, if we take the above example, where the borrower has 5 lacs as surplus and he is looking to prepay this much amount after 12th instalment i.e. after 1 year then the EMI will be reduced to ₹ 33,115.72 or the number of instalments to be repaid will come down to 164 approx. from 228 (240-12).

So, in this case, the borrower will be able to save around 6 lacs in interest if he prepays ₹ 5 lacs towards his loan. But this won’t hold true if the borrower prepays the same amount after 180th loan instalment (15 years) as then he/she would only be saving 1.3 lacs in interest.

Also Read: Saving & Investment – Six points to keep in mind before investing

Hence, it makes more sense to repay a part of your debt in the initial years.

Foregone interest benefit…

Under section 24, an investor can claim deduction on the interest paid on home loans up to 2 lacs. So, for an investor in the 30% tax bracket, this translates into total savings of around 60,000.

In the above-taken example, an investor would be able to enjoy tax benefits in full up till 15 years whereas if in case the investor pre-pays 5 lacs in advance (at the end of 1 year) then the benefit of 2 lacs will be available only up till 13 years in that case.

Note: – You will continue to get the tax benefit under section 24 even after 13 years but the total interest payable in the subsequent financial years will come down below 2 lacs (since you have repaid a part of the principal) and that’s why we have not considered it in the above calculations.

Investing the surplus…

If the borrower considers investing the same amount (5 lacs) at the end of 1st and 15th year then at 12% rate of return (a reasonable expected rate of return from equity mutual funds) the borrower would have got 43.06 lacs and 8.81 lacs respectively if the amount is invested and held throughout the left tenure of the loan.

So, prima facie we can say that the investor will be better off by investing the surplus amount rather than pre-paying his/her loan.

Hence, an investor should always look at the spread between the expected rate of return and the home loan interest rate. If it is 0.5% or 1% then you can look at repaying your home loan but if the spread is 3-4% or even more, then you should definitely invest the surplus amount rather than repaying your home loan.

When a loan should be pre-paid-

1.) Risk-averse

If you are a kind of investor who is not able to stomach the volatility of the equity markets and is only comfortable with traditional instruments like fixed deposits, recurring deposits, etc then you should first prepay your loan rather than investing it. This is only valid when the borrower is considering repaying a part of his/her debt upon reaching closer to the tenure end.

2.) Mental set up

Living a life free from any kind of burden and debt gives a sort of happiness to many individuals. So, if you think that you cannot live with burden on your head then you might consider repaying it. But do not forget to foresee any major expense that might be coming your way in the near term as you won’t get the repaid amount back.

3.) Debt consolidation can be looked at

If you have multiple loans then you may consider some debt consolidation by repaying some of your loans. For example, you may foreclose your car or personal loans as they do not offer any tax benefits. Moreover, your CIBIL score will improve if you pay your loans in advance.

When should you invest the surplus amount you are having…?

1.) Job security

When the borrower has a stable job and he/she can service EMIs in a timely manner then they may continue with the loan and invest the surplus amount in mutual funds. If you need any help regarding mutual fund investments then you can always contact Budwisefunds, we are always at your service.

2.) Liquidity position

A sound liquidity position is a prerequisite. So even if you have multiple assets in place but not adequate cash then you should invest this surplus amount in liquid or debt funds rather than repaying your debt.

Further Reading: Business Today