Are you aware of the fact that the bank in which you deposit your hard-earned money can go into liquidation? Well, a bank can become bankrupt or its license can be cancelled by RBI due to violations of rules.

Further Reading: FD Jaisa Lagta Hai

There have been only two instances till date which includes the fall of Palai Central Bank and Laxmi Bank Ltd. The need to ensure the deposits came after the crash of these two banks. And hence on 1st January 1962, Deposit Insurance Act came into force which was later changed to Deposit Insurance and Credit Guarantee Act (DICGC), 1961.

DICGC is entrusted with the responsibility of covering deposits of the depositors’ up to a maximum limit of Rs 100000. All the deposits made with the commercial banks including their foreign branches and cooperative banks are covered by DICGC. The cost of insurance is to be borne by the banks and not by the depositors.

Also Read: Credit Card – Should I apply for a credit card?

THINGS TO BE KEPT IN MIND:-

- The limit of Rs 100000 includes both principal and interest. Any amount over and above the limit is not insured.

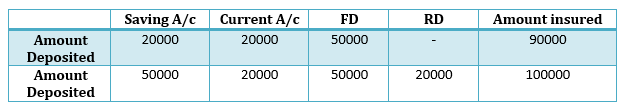

- The insurance cover of Rs 100000 is inclusive of all your deposits in the form of savings account, current account, fixed deposits or recurring deposits.

- Deposits held in other branches of the same bank are not eligible for extra insurance cover however; if the deposits are with the other bank then those will be covered separately. For example, if you hold FD of Rs 100000 each with SBI and HDFC bank then these are separately insured by DICGC i.e. you are insured up to Rs 200000.

- The accounts held jointly are also covered by DICGC. The accounts in which the names of the joint holders are not in the same order are also covered separately. For example, a joint account with names in the order A, B & C and B, C & A will be treated separately and are eligible to receive Rs.100,000 each.

CAN A INSURED BANK WITHDRAW ITSELF FROM DICGC COVERAGE

No, it is mandatory for all commercial banks to get themselves insured by DICGC. However, DICGC may cancel the registration of the insured bank if the bank fails to pay a premium for 3 consecutive periods or if the RBI cancels the license of the bank or if the bank gets prohibited from accepting fresh deposits. The intimation regarding the cancellation of the coverage is to be published in the newspaper.

Further Reading: DICGC