If you are among those investors who started investing in mutual funds 2-3 years back then you might be feeling discouraged with the kind of returns equity mutual funds have generated over the past few years.

Further Reading: Best Mutual Funds

The problem would have been worse if you have invested in smallcap and midcap mutual fund schemes.

But wait; are you thinking of getting rid of your previous schemes and want to switch your existing investments towards those schemes which are performing and probably are on top?

Then, think again, before taking any decision regarding switching funds.

Even SIP returns have also started going into negative territory except for the few funds. This has caused misery to those investors who had initiated SIP thinking that they are risk-free and can generate superior returns. Well actually, SIP only helps you to ride through the volatility; it can never eliminate the underlying risk of the equity markets. However, one should not shun equities just because they are volatile in nature as these are the only asset class which can generate superior risk-adjusted returns.

So, now coming back to our main discussion that why you should not switch your non-performing schemes too frequently and chase top performers. These are explained below:-

- BE PREPARED – Equity as an asset class is volatile in nature. And hence one should always be ready for situations when your returns might be even negative. But one should not be taken aback if you see negative returns as it might be a temporary blip.

- UNDERSTAND THE REASON WHY THE SCHEME IS NOT PERFORMING – Not only the economy or equity markets move cyclically, but the mutual fund schemes also move in the same manner. The reason behind this is that the fund managers’ investment view differs from each other and hence the underlying securities of the particular scheme may take time to play out.

- GIVE TIME TO YOUR INVESTMENTS – You should not hop from one scheme to another within a short span of time. It will not only lead to churning cost but also restrict you from earning returns. Trust the fund manager, who is there for you, he himself will change the asset allocation if required.

- TOP PERFORMING SCHEME MAY NOT ALWAYS REMAIN ON TOP – An investor should not chase returns and also not an outperforming scheme. A scheme that is currently on top and outperforming, might or might not perform and generate the same returns in the future. Hence, one should stick with a scheme as long as it is beating its benchmark and category average returns.

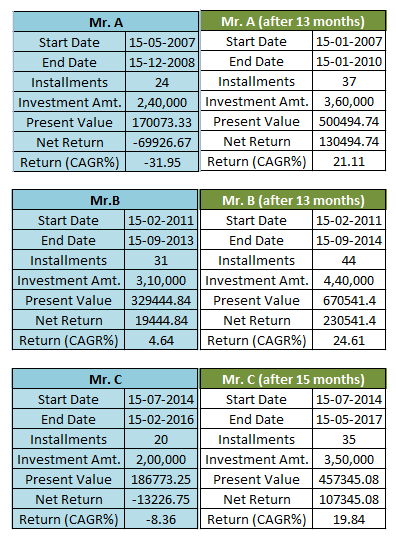

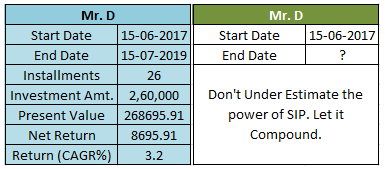

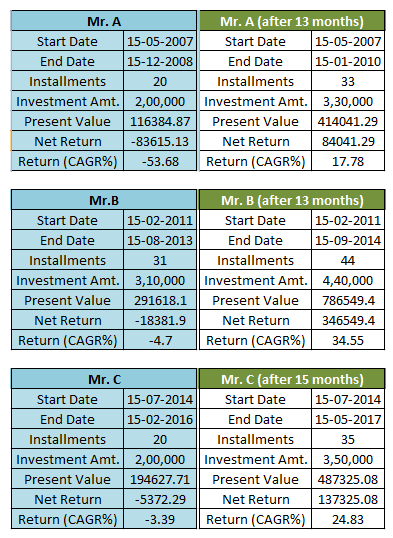

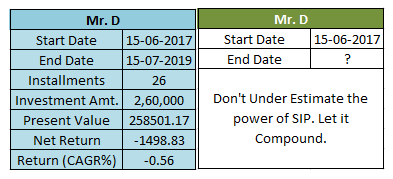

- For your better understanding, we have analyzed two schemes – Kotak Equity Opportunities Fund and Kotak Emerging Equity Fund. In both the schemes, the individuals are investing Rs 10,000 through SIPs across different time periods.

Further Reading: Mutual Fund Sahi Hai

Kotak Equity Opportunities Fund

The scheme invests in a mix of both large and mid cap companies. The scheme was launched on 9th Sep, 2004. Since inception the scheme has generated returns of around 17.74% on CAGR basis. The scheme is a consistent outperformer in its category. The current fund manager of the scheme is Mr. Harsha Upadhyaya. Also, the AUM of this scheme is currently standing at 2577.47 Cr.

Also Read: Are equity mutual funds risky?

Kotak Emerging Equity Mutual Fund

This scheme invests predominantly in mid cap companies and was launched on 30th Mar, 2007. The current fund manager of the scheme is Mr. Pankaj Tibrewal. The current AUM of this scheme is around 4500 Cr. The scheme is an outperformer in the past 5 years.

CONCLUSION

As you can see above, if the individuals remained invested for just few more periods(13 months), then they would have gained much higher returns than quitting their SIPs in between. Hence, we can draw an inference that a person would be able to convert his nominal losses into superior returns if they keep investing and remain invested for long period. All that is required is a little patience and courage on the part of investors and returns will follow you then.

Further Reading: Financial Express