We individuals generally have the tendency to put off things for tomorrow.

If you go and ask anybody that have they started planning for their child’s higher education or marriage then they might call you a moron. An individual dreams of fulfilling various goals in his lifetime.

Also Read: How much income should I earmark for investment purpose?

And for achieving these goals we work day and night. In this article, we will discuss the Eight golden rules for investments

No one knows your goals better than you. And hence one should always plan their investments only after considering one’s goals. Most of the individuals try to replicate their peer groups and make mistakes without even realizing it. If you are not very sure how you should go about your investments than you must seek help from financial advisors.

Further Reading: How to Invest in Mutual Funds

In this article, I am going to talk about the golden rules which an investor must know, how they should go about their investments and achieve their financial goals.

Start early – one of the Eight golden rules for investments

One must start investing as soon as they start earning. It is never too early to invest and plan for your goals. Take your first step by starting a SIP today. You will get a sense of relaxation if you start investing for your future goals now.

For example, you are 30 years old and want to create a corpus worth Rs 1 crore for your retirement at age 60 years. So, if you start investing today and the returns expected on your investments is 12% p.a. then you are required to invest only Rs 2832 per month while on the other hand if you delay making investments by say 10 years then this monthly contribution will shoot to Rs 10,008.

Stay invested for long

You may have come across a line that says that change doesn’t happen overnight. It is true for your investments, as well as your investments, also need time to grow. Also, the magic of compound interest can only be seen if you stay invested for long.

For example, a sum of Rs 1 lac invested @ 12% for 10 years and 30 years will become 3.1 lac and 29.9 lac respectively. Hence one should remain invested for long without worrying much about short term volatility of the markets.

Also Read: NPS – Should we invest in NPS when we have mutual funds as an option?

Align investment to goals – another one of the Eight golden rules for investments

Most of you might be making investments without aligning it to your goals which may create a problematic situation when you will require funds for your goals. Ideally, you should always match your goals with your investments.

For example if your goal is 2 years away then you cannot afford to invest in equity shares. And hence you should invest in relatively safe instruments like short term debt funds, etc.

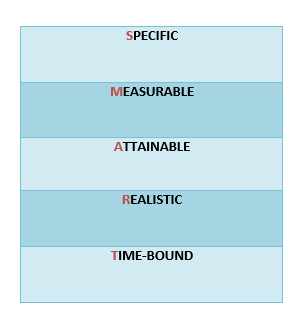

Your goals should be SMART

You should not dream about something which is irrelevant and not achievable with your current salary. Instead, your goals should be clearly defined, specific and bounded by time. For example, suppose your goal is to buy a home of your own. But you haven’t decided till when you want to buy it and how much will it cost you in future. And hence you will not be able to plan and invest for the achievement of your goals.

Further Reading: Mutual Fund Sahi Hai

Choose your asset allocation wisely

Asset allocation in layman’s term means making a decision in connection with the distribution of funds across various asset classes like equities, debt, gold, etc. You should not put all your money in one asset class say for example in equity just because of the returns they offer. One should always spread his investments across various asset classes.

Also, your asset allocation will depend upon your risk appetite, liquidity requirements and your time horizon.

Arrange your goals based on priority – one of the Eight golden rules for investments

Let me explain this with an example. Suppose an individual who has just started earning wants to buy a car, a home of his own, want to plan his holidays, and his retirement.

So, instead of hopping directly upon your goals, you should first arrange them on priority basis and then accordingly plan your investments. So in the above quoted example,the goals should be arranged like this – home, retirement, car, holidays.

Keep monitoring

If you have started making investments and thinking that you have done your job, then you are wrong. Monitoring your investments is as important as investing money. You cannot sit back and relax. You have to keep a track of your investments to check whether they are performing well and are you on the right path of achieving your goals.

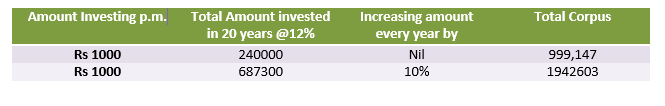

Increase your investment every year

If you are a salaried person then you probably get a raise every year in your salary. But what you generally do with the extra income you got? Presumably you increase your expenses by buying new stuff which you might not even need. Right… But have you ever consider increasing your investments by the same rate along with the rise in your salary?

If the answer is no, then you should start increasing your investment as and when your salary increases. To give you a view of this strategy, look at the following two scenarios wherein in one you are increasing your investments while in the other you are not.

Further Reading: aegonlife