Giving away is the hardest thing ever, especially when it comes to our money. Being a good citizen of the nation we all pay taxes to the government for nation-building and to avoid any scrutiny from the tax department.

Further Reading: What is Mutual Fund

Well, no one wants to share his/her hard-earned money with anyone except one’s own family.

But tax evasion is not an option and hence you should look for legal ways of reducing your tax liability. Government offers its citizens a number of tax sops which they can avail to bring down their tax liabilities.

Some of those tax sops have been discussed below:-

1) Section 80 C

It is the most common and widely used section of the Income Tax Act, 1961. The maximum deduction allowed under this section is ₹ 1.5 lacs. A number of deductions eligible under this section have been discussed below: –

- Home Loan Principal Repayment

Only the principal component of the home loan EMIs can be claimed as deduction under this section. The interest component is also eligible for deduction under the different section which has been discussed later in the blog.

- Tuition fees of the children

There is a misconception among parents that the entire school fee is eligible for deduction which is not true. Only the tuition fee component of the school fees is eligible for deduction under section 80C.

- Life Insurance Premium including ULIPs

Most of the people are aware of this thing that the premium paid towards life insurance policies is also eligible for deduction. However, most people are not aware of the conditions that should be met, in order to be eligible for claiming a deduction. These conditions have been discussed below

|

Premium paid on insurance policy other than a contract of a deferred annuity |

Amount paid eligible for deduction |

|

a) for a policy issued on or before 31.3.2012 |

20% of the capital sum assured |

|

b) for a policy issued on or after 1.4.2012 |

10% of the capital sum assured |

|

c) for a policy issued on or after 1.4.2013 for the insurance on life of a person, who is – i) a person with a disability or a person with severe disability as referred to in section 80 U ii) suffering from disease or ailment as specified in the rules made under section 80DDB |

15% of the capital sum assured |

The above-mentioned conditions are applicable on single premium policies as well.

- Tax Savings FD

The investment made in tax-saving fixed deposits can also be claimed as deduction under this section. Remember that these FDs come with a lock-in period of 5 years and no loans or premature withdrawals are allowed.

- PPF contribution

The investment made towards PPF account is also eligible for deduction. The overall deduction is inclusive of investment made in the PPF account opened in the name of a minor.

- EPF contribution

Only employees’ contribution to the EPF account is eligible for deduction under this section. Employer’s contribution is not taxable in the hands of individuals and also is not eligible for deduction under this section.

- Investment in NSC (National Savings Certificate)

An investor can claim a deduction for the investment made in NSC. Not only can the initial investment be claimed as a deduction but the subsequent accruing interest on initial deposits can also be claimed as a deduction.

For example, Rs. 1,00,000 is invested in NSC and the current interest rate is 7.9% p.a. Then after 1 year the accrued interest worth Rs. 7,900 can be claimed as a deduction under this section.

Again in the next year accrued interest worth Rs. 8,524 can be claimed as a deduction. Interest for the subsequent years can also be claimed in the same manner.

- Investment in SSY (Sukanya Samriddhi Yojana)

Investment made towards SSY is also eligible for deduction under section 80C. A parent can open an account for a maximum of 2 daughters but the combined investment in the two accounts cannot exceed the overall limit.

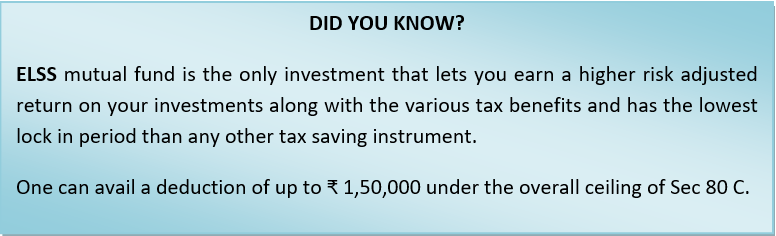

- ELSS investment

Note: – The deduction of 1.5 lacs is inclusive of all the above listed it

2) Section 80 CCD – NPS Contribution

Under this section, the contribution made towards NPS (National Pension Scheme) or APY (Atal Pension Yojana) is eligible for deduction. This section is bifurcated into 3 sub-sections.

- Section 80 CCD (1)

Salaried individuals can claim tax deduction up to 10% of gross income under Sec 80 CCD (1) with in the overall ceiling of Rs. 1.5 lac.

- Section 80 CCD (1b)

This section allows for extra deduction up to ₹ 50,000 for the contribution made towards Tier – I account of NPS. This deduction is over and above the ceiling of 1.5 lacs.

- Section 80 CCD (2)-

The contribution made by the employer equivalent to 10% of employees’ salary (basic + DA) towards NPS account is eligible for deduction under this section. There is no limit on the amount of deduction under this section.

Also Read: Reduce Investment Risk with Practical strategies

3) Section 80 D – Health Insurance Premium

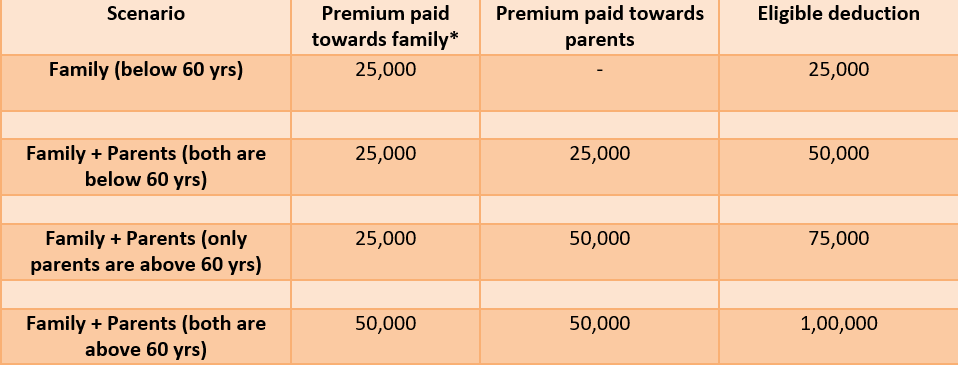

An individual, who is below 60 years of age, can claim deduction up to ₹ 25,000 for the premium paid towards health insurance policy covering self, spouse and dependent children.

If you are a senior citizen then you can claim up to ₹ 50,000.

Also, if you pay health insurance premium for your parents who are also senior citizens then you can claim deduction up to ₹ 100,000 (50,000 for self + 50,000 for parents).

*Family – Self, spouse, and children (dependent)

* Dependent age should be less than or equal to 25 years of age.

Not only this, any payment made towards preventive health check-up of the individual or any other member of his family is eligible for deduction to the extent it does not exceed Rs. 5,000 in aggregate. This deduction is inclusive of the overall limit of deduction i.e. 25,000/50,000.

Further Reading: Mutual Fund Sahi Hai

For example, you are paying a premium of Rs. 22,000 towards a health insurance premium and paid Rs. 5,000 towards your family’s preventive health check-up.

So here you will be able to claim a maximum deduction of Rs. 25,000 as the overall limit under section 80D is capped at Rs. 25,000 (family below 60 years of age).

4) Section 80 G

The deduction under this section can be claimed by all assessees, on account of any donation made by them to specified funds or institutions.

In some cases, the deduction is allowed to the extent of 100% while in some cases, the deduction is available only to the extent of 50% of the total donation made.

5) Section 80 TTA – Interest on Savings Bank Account

Interest earned on the savings bank account up to ₹ 10,000 is eligible for deduction under this section. Interest earned on fixed deposits, recurring deposits, etc cannot be claimed for deduction under this section.

6) Section 80 E – Interest on Education loan

Under this section, an individual can claim a deduction for the interest paid on the education loan that has been taken for higher studies of self, spouse or children from any bank or any other financial institution.

There is no limit on the amount that can be availed as a deduction.

The deduction for the interest on the education loan can be availed for 8 years from the year in which you start repaying the loan.

7) Section 80 TTB – Interest on S.A./ FD/RD

This section is exclusively available for senior citizens only. Under this section, senior citizens can claim deduction up to ₹50,000 on the interest income.

Unlike section 80 TTA, this section includes interest received from a savings bank account, fixed deposits, recurring deposits, etc.

8) Section 24 – Interest on Home Loan

Generally, a large chunk of the salary of the individuals goes towards home loan EMIs.

Homeowners can avail a deduction of up to ₹ 2 lakh on the interest paid towards their home loans if the owner themselves are residing in the property. The treatment is the same when the house is vacant.

While on the other hand if the house property has been let out then there is no limit on the amount of interest that can be availed as a deduction.

The deduction would be limited to ₹ 30,000 if any of the following conditions is not met:-

- The loan must be taken for purchase and construction of house property

- The purchase or construction must be completed within 5 years from the end of the financial year in which the individual has taken a home loan

- The loan must be availed after 1st April 1999

Also Read: Risk-O-meter in mutual funds

Strategies an individual taxpayer can follow –

- Apart from all of the above tax deductions, a salaried individual can even reduce his/her tax liabilities by opting for the allowances/perquisites that are tax exempted. Since medical and travel allowances have now been made taxable, one may replace with other tax-free allowances/perquisites.

Some of the perks that are exempted from tax on submission of actual bills and subject to reasonable limits and usage are discussed below: –

- Newspaper/Books/ Periodicals Reimbursement

- Food coupons

- Telephone and Internet Reimbursements

- Leave Travel Allowance

- Tax Harvesting of LTCG

With the introduction of a capital gain tax on the long term capital gains from equity shares or equity mutual fund units, investors should harvest their capital gains every financial year.

This can be done by booking capital gains every year and by investing the same amount again.

Long term capital gains from equity funds are exempted from tax up to Rs. 1 lac and capital gains of the retail investors may not even cross this limit in the initial years.

But going ahead capital gains will add up to a great sum which will result in huge tax liability.

- Tax Loss Harvesting

An individual can also limit his/her tax liability by selling the loss-making equity shares or equity mutual fund units and offset them against capital gains.

Capital losses can be set off against both i.e. long term as well as short term capital gain.

Usually, this technique is adopted by traders to reduce their STCG as tax rates on short term capital gains is on a higher side.

Although, assessees can adopt this strategy throughout the year, it is generally considered at the end of the financial year when income tax return has to be filed.

Further Reading: Aegonlife