Capital assets like land and building appreciate in value over a period of time. And can attract huge capital gains when sold. However, Section 54 EC of the income tax laws provides many tax sops to the individuals. That can help them in reducing their total tax liabilities.

Agricultural land is not considered as a capital asset. And hence does not attract any tax on capital gains arises from its sale.

For example, if you are using your entire sales proceeds in purchasing or constructing a new house property then you are exempted from paying any tax on capital gains. But there are certain conditions that have to be met in order to be eligible for availing exemption.

Further Reading: Mutual Fund Sahi Hai

But what if you are not planning to purchase or construct another house property. Well don’t worry, Income Tax laws have provided rescue to even such kinds of individuals who do not want to build or purchase another house for themselves. This has been covered under section 54 EC.

Section 54 EC of the Income Tax Act, 1961 allows any person (including individuals, companies, HUF, etc) to avail exemption in respect of long term capital gains arising out of the sale of a capital asset (land or building or both). Long term capital gain is the gain that is derived out of the sale of a capital asset held for more than 24 months (i.e. 2 years) after adjusting it for indexation. The capital gains reinvested in part or in full within a period of 6 months of receiving proceeds in the “long term specified assets” will be exempted from tax. “Long term specified asset” is any capital gain bond issued by selected entities that are redeemable after 5 years.

FEATURES OF Section 54 EC BONDS

- Safe and Secure –

These capital gain bonds are highly secured and highly rated (AAA). Bonds issued by NHAI (National Highway Authority of India) ,REC (Rural Electrification Corporation), IRFC (Indian Railway Finance Corporation) & PFC (Power Finance Corporation Ltd) have been specified for this purpose.

- Interest Rate –

Currently, the interest rate offered by these bonds is 5.75% and the interest is payable on an annual basis.

- Tenure –

The lock in period in case of capital gain bonds has been extended from 3 years to 5 years (effective 1st April, 2018). Also, these bonds cannot be encashed before the lock in period and also are non- transferrable.

- Taxability

Interest received on these bonds is taxable in the hands of the investors; however no TDS will be deducted on the interest.

- Investment amount

An investor has to subscribe at least 1 bond amounting to ₹10,000 and can subscribe a maximum of 500 bonds taking the total investment to ₹ 50 lacs in a financial year.

Also Read: Mutual Funds : 8 good reasons why you should invest in these funds?

Quantum of deduction

- If the amount of capital gain is equal to or less than the cost of long term specified assets acquired within a period of 6 months, then the entire capital gain will be exempted from tax.

- If the amount of capital gain is more than the cost of long term specified assets acquired, then the exemption will be provided up to the cost of long term specified assets.

Simply put, capital gains from the transfer of any land or building shall be exempted to the extent it is invested in the long term specified assets within a period of 6 months from the date of such transfer capped at Rs. 50 lakhs.

What if the capital gain bond is transferred before completion of 5 years

If the bond acquired is transferred or converted (otherwise than by transfer) into money at any point of time within a period of 5 years from the date it has been acquired. Then the whole amount exempted earlier under section 54 EC shall be deemed to be long term capital gain of the previous year i.e. the year in which the capital bond is transferred or converted into money.

Not just transfer, even if the assessee takes any kind of loan or advances against this bond within a period of 5 years then also the whole exempted income shall become chargeable under the head “capital gains”.

For example, suppose an Assessee acquired a capital gain bond for a value of Rs. 50 lakhs in FY 2019-20.

But in the subsequent year i.e. in FY 2020-21 assessee encashed that bond.

So, the whole amount of capital gain which was earlier exempted will become income of that year which is to be shown under the head capital gain i.e. chargeable to tax in AY 2021-22.

Can you take the advantage of two financial years by timing the sale of an asset (land/ building)

An assessee cannot claim the exemption in excess of Rs. 50 lakhs by spreading his investments in two financial years.

This overall limit of Rs. 50 lakhs is inclusive of investment made in the current financial year as well as in the subsequent financial year.

For example, Mr X sold a house on 1st January 2020. The transaction generated a long term capital gain of Rs. 75 lakhs. So in order to claim an exemption under section 54 EC, he needs to invest capital gains within 6 months i.e. up to 30th June.

Mr X has already purchased bonds worth Rs. 25 lakhs in the current financial year i.e. FY 2019-20 on 20th March 2020. So, in the next financial year i.e. up to 30th June he can acquire additional bonds of worth Rs. 25 lakhs only and not for whole 50 lakhs.

What if you don’t avail exemption under Section 54 EC?

You will have to pay tax on the entire capital gain at a flat rate of 20% after indexation.

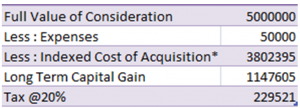

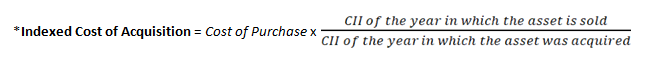

For example, you have purchased land for Rs. 25 lakhs in April 2010 and sold this land in March 2017 at an agreed price of Rs. 50 lakhs.

Expenses incurred on transfer of this asset are Rs. 50,000. So the tax on capital gains will be calculated as follows –

You could have saved Rs. 2.2 lakhs approx. in taxes by investing your capital gain in capital gain bonds.

Further Reading: Best Mutual Funds