Realizing the need for making an investment is equal to achieving half a milestone. People often consider investing as the last thing whereas it should be there priority.

Further Reading: What is Mutual Fund

One should see it as investing for themselves and for their own future goals. A casual attitude towards investment is like pushing your luck. Start making investments in the initial years of your job can be of much help.

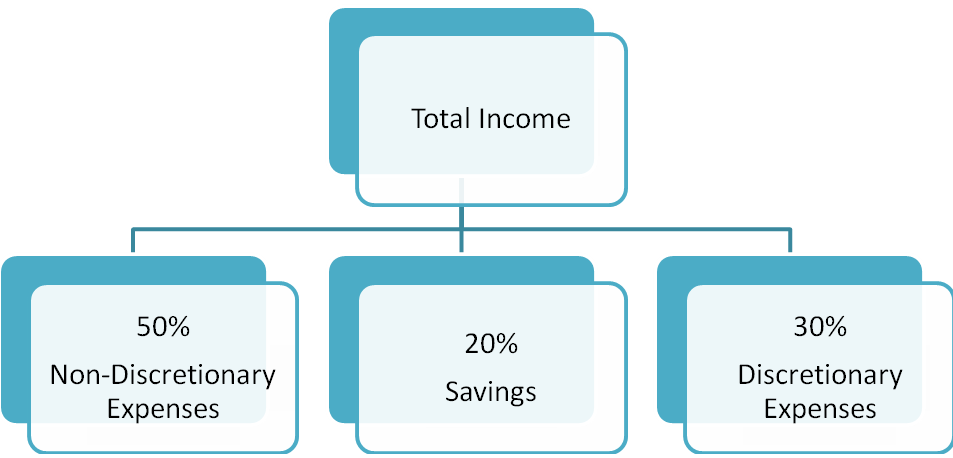

An individual should apportion his/her income based on Rule 50/20/30. According to this rule, an individual should utilize 50% of his/her income for necessary expenses, 20% of the income should be utilized for saving purposes and the rest 30% can be used for discretionary expenses or spending.

An individual should not blindly follow this rule. As it will be always better if you allocate more portion of your income towards savings.

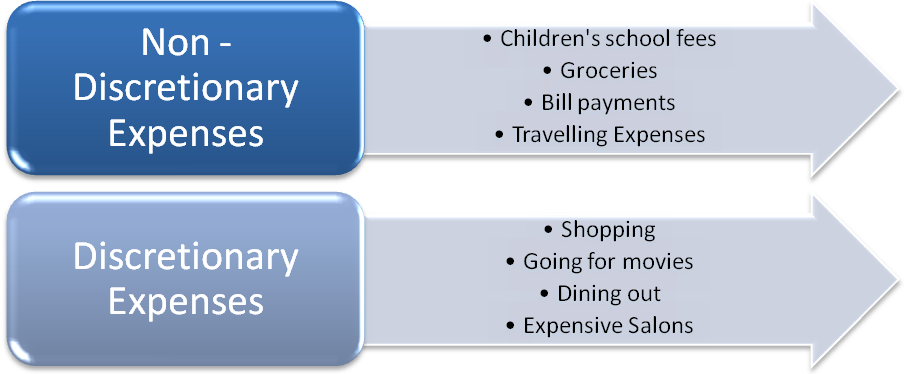

Difference between Discretionary and Non-Discretionary Expenses or Investment

Discretionary expenses are those expenses that are contingent upon your lifestyle or your wants. These are those expenses without which an individual can get by. On the other hand, non-discretionary expenses are the mandatory expenses that an individual has to make.

These expenses are better defined as needs rather than wants. A person can control his/her discretionary expenses but it is not possible to control one’s non-discretionary expenses.

Also Read: Save Money, Secure Your Future – What will be the ideal amount I should save every month?

Often young earners spend money extravagantly. They do not care about their future and focus only on their present. Though this might not be true for everyone but for the majority of them.

Some points to be kept in mind While Investment…

1.) Earlier the better

The earlier you invest, the better it is. The benefit of investing early is that your investments will be compounded for more number of years. For example, a sum of ₹ 1,00,000 invested today will grow to 3.1 lakhs in 10 years if the investment earns 12% p.a.

The same invested amount can grow to 9.6 lakhs and 29.9 lakhs in 20 years and 30 years respectively due to the power of compounding.

2.) It’s never too late

Though it is always better to invest upfront, that doesn’t mean you have missed the bus and can’t board another bus to reach your goals. The only thing is that you have to bear some extra cost for that i.e. you have to invest more in order to accomplish your goals.

3.) The amount doesn’t matter

It doesn’t matter how small you invest, what matters is the time period for which you are investing. Mutual funds provide investors with the flexibility of investing a sum as low as ₹ 500 through SIP which is not at all a big amount even for young learners.

You will be surprised to know that a monthly SIP of just ₹ 1000 can get you a little over 97 lakhs in 40 years @12% p.a.

4.) Patience is the key to success

If you are investing in mutual funds schemes especially equity-oriented then you must ignore the normal ups and downs of the markets.

An investor should remain focused on his/her goals and invest and hold investments for the long-time period for optimum results.

Further Reading: Livemint