Few AMCs provide free insurance cover to lure new investors and also to retain existing ones. This insurance benefit is exclusively available to only those investors who invest via SIPs.

Further Reading: Mutual Fund Sahi Hai

The main objective is to provide additional benefit in the form of free life insurance cover to the long term investors by helping them in achieving their goals along with providing security to their family members.

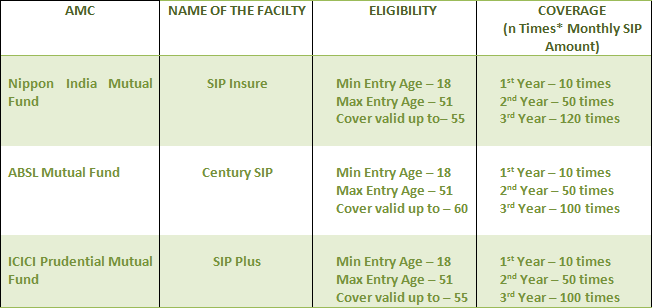

As on date, there are three AMCs namely ICICI Prudential Mutual Fund, Aditya Birla Sun Life Mutual Fund, and Nippon India Mutual Fund which are offering this bundled product (SIP + Insurance).

But the main question here is should you invest in those schemes which are eligible for insurance just because they are providing you a free insurance cover?

Before digging into that let us first understand how this bundled product works.

The investors who invest in eligible schemes offered by various mutual fund houses via SIP can opt for a free life insurance.

The investor will receive an Insurance cover note directly from the insurer on yearly renewals via sms /email stating the details of the insured and coverage amount.

Also Read: What is Mutual Funds and its types?

For example, if you are investing in any eligible scheme of ABSL mutual fund then you have to opt for CSIP (Century SIP) in order to get free insurance cover.

And in case of happening of an unfortunate event, the nominee gets the sum assured along with the fund value.

The AMCs provide this SIP plus insurance cover to the investors by buying group insurance from the insurers at cheap cost.

However, there are many conditions attached to this bundled product which makes it a little complicated for the investors. These conditions have been discussed below: –

1.) AMOUNT OF COVERAGE –

The insurance cover provided by the AMCs depends on the amount the investor is investing via SIPs. For example, if an investor is investing Rs 10,000 on a monthly basis then he/she will get a cover of Rs 1 lac (10*10,000) for 1st year, Rs 5 lacs (50*10,000) for 2nd year and Rs 10 lacs (100*10,000) cover for the 3rd year. The maximum cover provided by all the AMCs is capped at 50 lacs.

NOTE: – The insurance cover is available only to the First/Sole investor and not to the other joint holders.

2.) COVERAGE IF SIP IS DISCONTINUED

- SIP Discontinued Before 3 Years –

One has to continue his/her SIP for at least 3 years in order to be eligible for insurance cover. If you discontinue SIP before 3 years then you will not be eligible for insurance cover thereafter.

- SIP Discontinued After 3 Years –

If you discontinue SIP after 3 years, then you will still be eligible for insurance. The insurance in this case will be equal to the fund value (value of the units acquired under CSIP/SIP Plus/SIP Insure) at the beginning of each financial year or 100/120 times of monthly SIP amount whichever is lower, subject to a maximum of Rs 50 lacs.

Further Reading: Money Control

3.) CESSATION OF COVERAGE

- Partial/Full Redemption

The insurance cover will be ceased if an investor withdraws investment either partially or fully or switches out before completion of the SIP tenure/installments or before attaining 55 years of age.

- Default in SIP

If an investor defaults on SIP installment, then also his/her insurance coverage will come to an end. For example, in case of schemes offered by ABSL mutual fund if an investor defaults in payment for two consecutive installments or on four installments on different occasions during the tenure of SIP chosen or till attaining 55 years of age whichever is earlier, the insurance cover will be ceased. This in case of Nippon India and ICICI Prudential mutual fund schemes is three and five installments respectively.

- At the end of the tenure

The insurance cover will cease upon completion of the SIP tenure or after attaining the maximum age-eligible for insurance coverage.

- Investor intimates the AMC to discontinue the SIP

4.) EXCLUSIONS FOR INSURANCE COVER

- Death due to suicide within 1 year from the date of commencement of risk.

- Death within 45 days of commencement of risk except due to accident.

- Death due to pre-existing illness, disease(s) or accident which has occurred prior to commencement of SIP.

SHOULD YOU OPT FOR FREE INSURANCE COVER

There are no free lunches but you are getting a life insurance cover and that too free of cost. How could anyone miss it? Right? Well there is no harm in opting for the additional benefit you are getting at no cost but remember investing in these schemes just for the sake of getting an insurance cover makes no sense. If the scheme is performing well and suits your risk profile then you may go ahead and invest in that particular scheme without any second thought.

However, you should not rely entirely on this insurance cover and buy a separate cover for yourself because the insurance cover will cease as soon as you withdraw even a small amount from your investment and you will be left with no cover.

Further Reading: Tax Saver Funds