We all invest our money in the expectation of earning returns out of it. But what if we did not get that expected return on our investments. Probably we won’t be able to achieve our goals aligned with our investments.

Further Reading: Mutual Fund Sahi Hai

This probability or possibility of not earning the expected return on any particular investment is described as investment risk. Nevertheless, one can always prevent himself from falling for this risk by adopting various kinds of strategies. Some of these strategies to reduce investment risk have been discussed below:-

1.) Split and balance it helps to reduce investment risk

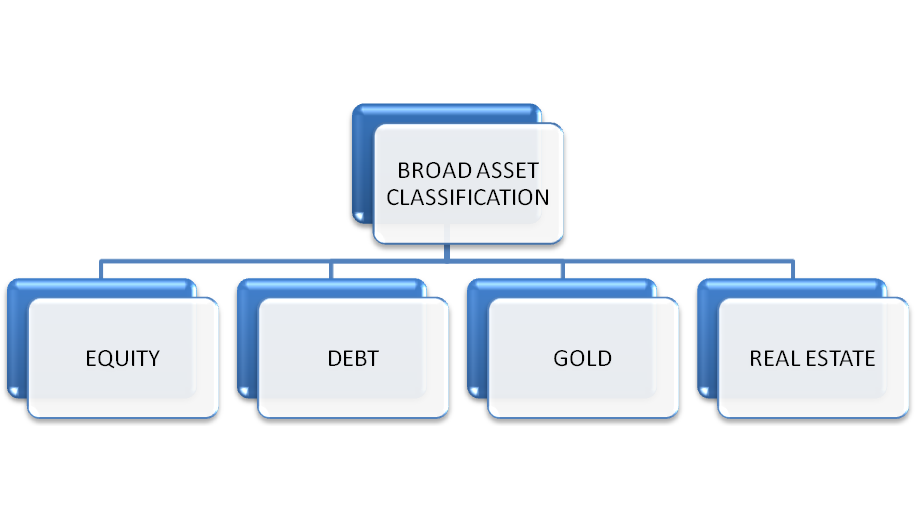

“Do not put all your investments in one basket” is a great saying by Warren Buffet. The statement is applicable to all the investors and hence should be followed by everyone. One should diversify his investments across various asset classes like debt, equity, gold, etc. And should not put all their money into only one asset class, let’s say in equity, as it could be very risky if the markets at large do not support and underperform.

Also Read: ULIP versus Mutual Funds ! Which is more suitable for you?

2.) Divide to grow helps to reduce investment risk

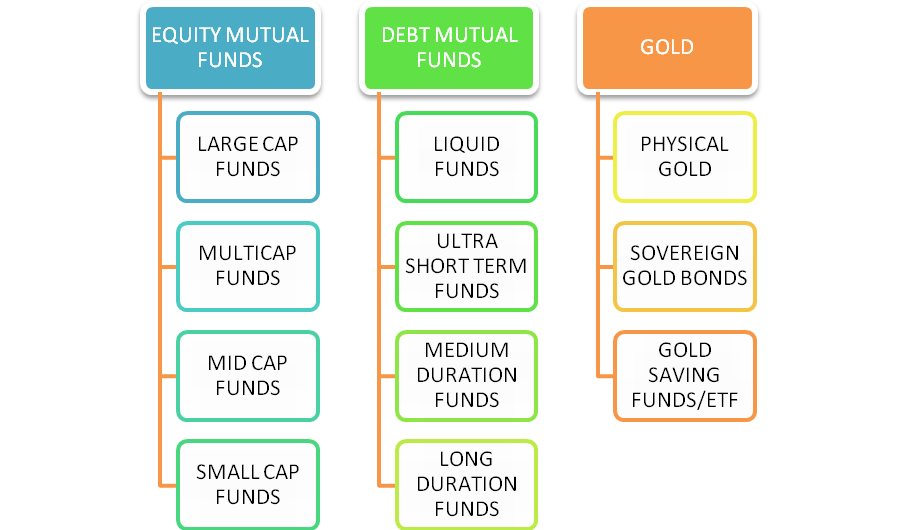

After choosing the allocation towards each asset class, one should decide the further division in that respective asset class chosen. For example, if you have decided to allocate 60% of the investment towards equity mutual funds then you must decide how much you need to allocate towards large-cap, mid-cap and small-cap funds respectively.

This is important because if you put all your investments in small-cap funds then you might have to face the volatility of markets and even losses in the short term.

3.) The pace with the market

Never try to beat the returns of the market by continuously churning your portfolios and betting on the recent past performers. Unnecessarily churning of the portfolios will only increase your cost in the form of exit loads, imposed by the AMCs.

You should stay put with your current investments for at least a few years and if still, they underperform its benchmark and peer group then you may switch towards a better scheme.

4.) Set your risk appetite helps to reduce investment risk

Different investors usually have different risk appetite. And hence instead of imitating portfolios of your peers, one should look at his own risk profile. The risk appetite of every individual is unique to himself. And hence there is as such no strategy which can be followed by all the investors.

Investors are easily carried away with the returns and thereby end up making mistakes by investing in risky funds without even knowing their risk appetite and regret later on.

5.) Beware the temptation to follow the herd

We all individuals usually suffer from the herd mentality. In other words, we tend to follow what others are doing. Because we think that if they are doing it then it has to be right, which is not correct at all.

We hear and get suggestions from our peers or colleagues about choosing a particular asset class since it has generated extraordinary returns for them in the past. And we even follow their suit. Well, this might work for some but not for all investors as the needs of the investors vary from each other.

6.) Don’t gamble, research

One should not choose a fund just because it is highlighted in the newspapers or on several websites. There are several other factors like risk appetite, liquidity needs, time horizon, etc. And an investor must bear all these factors in his mind before selecting a particular fund.

Also, if the markets are in a bull run and are generating astonishing returns do not get carried away by just looking at the returns especially of mid and small-cap funds as it could be fatal if things turn around.

For example, till 2017 mid and small-cap funds have been generating high returns of more than 20% and those who have invested at the beginning of 2018 (looking at the recent returns) are crying foul.

Hence it is in the best interest of all the investors that they should invest based on basic research on their part. Otherwise, take the help of a professional financial advisor.

Further Reading: Investopedia