ULIP or Unit Linked Insurance Plans are the insurance cum investment products in which a part of the paid premium goes towards investments while the rest goes towards risk coverage.

Further Reading: Best ULIP Plans

ULIP’s are the perfect blended products which one can resort to for wealth creation along with life cover.

There are four types of funds which are generally offered by insurers i.e. growth, income, balanced and bond funds. One has the option to switch between the funds based on the market conditions.

On the other hand, mutual funds are the pure investment products which pool money from various investors and then the pooled money is managed by a fund manager who in turn invest it across various asset classes.

Mutual funds have the potential of creating huge wealth over a period of time.

There are large numbers of funds being managed by various AMC’s. One may choose schemes based on his risk profile, liquidity requirements and time horizon.

Mutual funds often provide flexibility as individuals can park their idle funds even for just one day.

Now, lets quickly jump into the main part of our discussion i.e, should one go for ULIP’s or Mutual funds.

For ease I have made a comparison between the two on various parameters which will help you in making an informed decision:

1. RETURNS

The first and the foremost question which an investor usually have in mind is that which instrument will give you better returns?

Different investors have different expectations, some expect to earn a high rate of return by taking high risks and for some safety of capital is the topmost priority.

Both ULIP’s and mutual funds offer various types of schemes to risk-takers and risk averters. However, returns may vary across various schemes across different categories.

The 10 years average rate of returns in case of aggressive ULIP’s category is 9.57% while in the case of large-cap mutual funds, it is 12.23%.

Hence you may now see that which is the better investment option in respect of returns.

SOURCE: – MORNINGSTAR

SOURCE: – MORNINGSTAR

2.COST AND EXPENSE

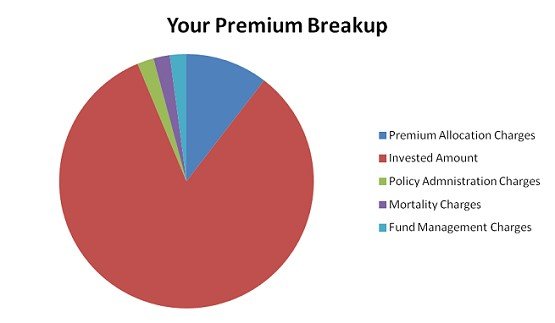

There are a number of charges associated with ULIP. These include premium allocation charges, mortality charges, fund management charges, policy administration charges etc.

In recent years, IRDAI has capped charges (excluding mortality) at 3% for policies with tenure of up to 10 years and thereafter it gets reduced every year and finally came down to 2.25% for those with a term of over 15 years.

As a result, the cost of ULIP’s has come down considerably. These investment-cum-insurance plans have now become a low-cost investment option. And hence one can think of having exposure to such products as they offer twin benefits.

However on the other hand, mutual funds have only expense ratio which may vary from as low as 0.10% (in case of liquid funds) to 2.50% at max (in case of equity funds).

There are no other extra charges as such; all the charges are compensated for in expense ratio. The expense ratio is easily available on the fund house websites.

Also, mutual funds are widely tracked by various independent websites and hence may provide lot information to DIY investors.

3. TAXABILITY

With the introduction of LTCG tax on stocks and equity-related mutual funds, the ULIP’s have become the talk of the town. The reason is that the maturity benefits from ULIP are tax-free under section 10(10 D).

Even earlier when there was as such no tax on long term gains from stocks and equity-related mutual funds, ULIP’s still had an edge over equity mutual funds.

The reason being the imposition of tax on STCG (short term capital gain) at 15% if units of equity-related mutual funds were sold within a period of 1 year and in case of ULIP’s, the switches are free and do not come under the ambit of capital gains tax.

Please remember that we can’t withdraw our money from ULIP before the completion of 5 years from the date of investment. But since ULIPs are insurance products, the gains are tax-free.

Insurers have started capitalising the opportunity by highlighting that the “long term gains from equity mutual funds will now be taxed at 10%, but still, the income from ULIP’s will be tax-free”.

But one must not forget the lock-in period in case of ULIP’s which is 5 years while in case of mutual funds (ELSS) the maximum lock in 3 years.

Further Reading: Mutual Funds Sahi hai

The tax-free advantage of ULIP’s is not limited to equity funds but is also extended to fixed income space. ULIPs generally have four funds option i.e. equity, balanced, debt and liquid funds.

So even in case of fixed income space ULIP’s have an edge over debt mutual funds as LTCG from debt funds are taxed at 20% after indexation. But again the gains from ULIPs are tax-free.

4.FLEXIBILITY

The switching facility in ULIPs provides some sort of flexibility to its investors. The investors can switch between various fund options based on the market conditions without any tax liability.

Though there is a limit on the number of free switches in a year some insurers provide unlimited free switches. Insurers claims, this makes ULIPs a perfect product where rebalancing can be done efficiently without any tax implication.

However, one must not forget that one has to make a multi-year commitment while buying ULIP’s as they generally have a maturity ranging from 5 years to 20 years.

Also, the investors are stuck with the same insurer.

While in case of mutual funds there is no such constraint on the investors to remain with the same fund house as they can easily redeem their investments or can easily switch into other schemes of the same fund house.

However, every redemption and switching in other funds might bring tax liability as redemption in one fund is considered as booking capital gains and hence one has to pay tax based on the nature of capital gains.

5.TRANSPARENCY

Mutual fund portfolios and ULIP’s portfolio are equally transparent and easily accessible. Both are widely tracked by several agencies that allow investors to have a look at the scheme portfolios.

This might help them in knowing funds allocation to different sectors or even holdings in individual stocks.

The reason being that, not all charges are taken into consideration while calculating NAV of funds. Some charges are charged directly by cancelling units allotted to investors.

For example, the NAV of your ULIP fund might have risen by 11% but your corpus would not have grown in the same proportion as it should be because some of your units got cancelled against charges.

In contrast, mutual funds are fairly transparent on charges as the charges are built into the NAV on a daily basis.

Also Read: Different Types Of Mutual Funds – A Detailed Analysis

6.LIQUIDITY

One of the important aspect to be kept in mind while making investments is for how long will you be able to stay in a particular investment vehicle.

Investors can exit mutual funds anytime subject to exit loads (if any) and can even make partial withdrawals anytime they want but ULIPs don’t offer this freedom to its investors as there is a minimum lock-in period of five-years and partial withdrawals can only be made when this lock-in period gets over.

Now, there are no surrender charges in ULIP after the completion of five (5) policy years.

Some people argue that having a minimum lock-in period will help investors in creating wealth over a period of time which otherwise would not have been possible as individuals tend to react very quickly if things start moving against their own market predictions and hence may make mistakes by withdrawing their investments.

As mutual fund investors face no such lock-ins, most tend to withdraw investments within 2-3 years.

Remember, the longer you remain invested, the higher will be your returns and hence more wealth will be created over a period of time.

7.CONVINIENCE AND CHOICE

An investment in mutual funds requires one-time KYC formalities. Once it is done you are good to make investments in any of the schemes offered by various fund houses without any hassles. You can invest online or offline in any mutual fund without any additional paperwork.

ULIP investors don’t have that luxury. Even after they fill-up the form online and make the payment, the paperwork needs to be completed offline. This may include medical tests and other formalities.

While ULIP is capable of satisfying the diversified needs of the investors with different risk appetite, mutual funds have a little more to offer.

There are funds where an investor can invest even for a day or two. While there is no such option available with ULIP’s. Hence in terms of offerings and ease mutual takes a clear lead.

Further Reading: Value Research Online

CONCLUSION OF ULIP VERSUS MUTUAL FUND

Throughout the discussion, I have mentioned that the needs of investors differ in many aspects and hence there is no single financial product which will satisfy all the needs of different investors.

One has to consider various factors like risk appetite, time horizon and taxability while choosing any financial product.

There is no straightforward answer to the question “Should one go for ULIP’s or mutual funds” as it completely depends on the investor’s needs.

So from the entire discussion, I hope you are in a better position to make an informed decision. Any financial decision must be made with proper deliberations in place and not in hastiness.

In case of any doubts, one always has an option to consult an advisor.