The past returns offered by mutual funds have filled investors with enthusiasm and has induced them to invest in mutual funds.

Further Reading: Best Mutual Fund

However, a million-dollar question that might be existing in the mind of every investor is that how an individual should choose the best mutual fund scheme.

Well, let me clear one thing that there is nothing like the best scheme and also it is not within the scope of any advisor or distributor of a mutual fund scheme to predict the best performer in any category.

Hence, the main goal of the investor should not be on selecting the best scheme but on achieving one’s financial goals. Most probably, your next question would be – how we will be able to achieve our goals without the best scheme?

As I said earlier there is nothing like the best scheme because today’s top performer may or may not be on top after a few years. So, what should be the ideal strategy of choosing a mutual fund scheme then? There are few factors which an individual can consider while choosing a fund. These are listed below:-

1.) PAST PERFORMANCE

One can get a fair idea how the scheme has performed in the past. However one must remember that the past performance does not ensure future returns from any fund. The idea is not only to see the returns but how consistently the fund has performed in the past 5 or 10 years and generated returns for its investors. So, one should look at the returns of the long term only. For example, CAGR returns of 5 yrs or more can be look over.

Also Read: Nominal rate Vs Real rate: Difference between nominal and real rate of return?

2.) RISK ADJUSTED RATIOs

Most of the investors look for only returns and completely forget the risk aspect. There are many ratios which an investor should look for before investing in any scheme. These are:-

- SHARPE RATIO – It is the risk adjusted ratio which is also known as reward to variability ratio. The ratio is defined as the excess return of the scheme (difference between risk free return and portfolio return) divided by the standard deviation (S.D) of the scheme. The risk free return can be taken as the return on T-bills issued by the government. Higher the sharpe ratio, the better it is.The formula of sharpe ratio is mentioned below:

Rp – Rf / S.D

- TREYNOR RATIO – This ratio is also similar to the Sharpe ratio except of the fact that instead of standard deviation it uses beta(market risk) of the portfolio. Higher the treynor ratio, the better it is as it shows better compensation made by the scheme for the risk taken. The formula of treynor ratio is mentioned below:

Rp – Rf / Bp

- JENSEN’s ALPHA – It is nothing but the extra return generated by the fund as compared to the return of the benchmark index. The fund with the highest alpha can be preferred as it denotes the better performance of the fund.

Alpha = Rp – Rf – Bp( Rm – Rf)

Where, Rp = Return of the portfolio

Rf = Risk free return

Bp = Portfolio beta

Rm = Market return

Further Reading: Mutual Fund Sahi Hai

- TIME HORIZON – The selection of a scheme should be guided by one’s time horizon. For example, a person who wants to invest for a goal which is just 3 years away then she should invest only in balanced mutual funds or in some cases a person can take exposure in large cap mutual funds while on the other hand if the goal is 5-20 years away then she can invest even in risky mutual fund schemes like midcap or small cap, if the investor’s risk appetite allows her.

- RISK APPETITE – Risk appetite can be defined as the amount of risk which an individual is willing to take. So, one should look at her risk profile before choosing any scheme. The selection of a particular scheme should be based on your risk appetite, and not on the returns generated by the scheme in the past.

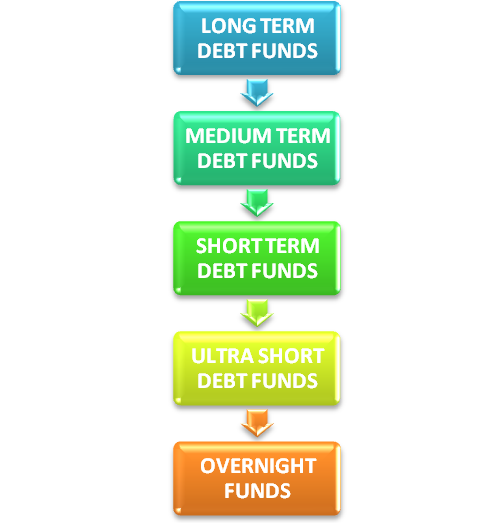

Debt funds have been arranged in the descending order based on underlying risk.

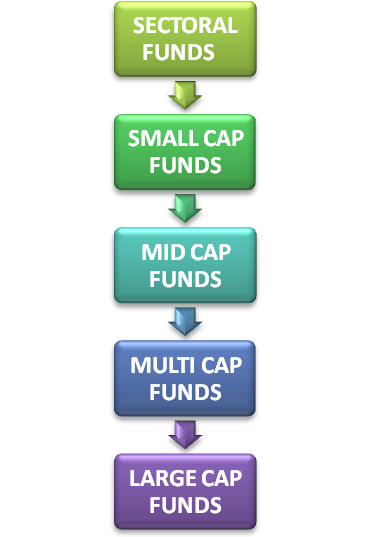

Equity funds have been arranged in the descending order based on underlying risk.

-

- FUND MANAGER’s PROFILE – The selection of a good mutual fund scheme can also be done by looking at the fund manager’s educational qualifications and past performance of the schemes he managed. Looking at the profile of the fund manager is important because he is the one who takes call on when and whether a particular security is to be bought or sold.

- AUM – You can have a look at the funds AUM (asset under management) which will give you an idea about the corpus or money being managed by a particular fund. A fund with a higher AUM can be preferred as it will have a low expense ratio. Also, higher AUM indicates that the fund is the delight of the investors and advisors.

Further Reading: EDELWEISMF