Investing through SIP in mutual funds has become very popular. To know why it is such an effective method to invest in mutual funds, read on!

Most of you might wonder, why there is so much buzz about investing all around. Is it really necessary that one should invest and plan their savings?

Well, the answer is yes. Each and every individual must invest in the achievement of their goals/dreams. Keeping your hard-earned money untouched in your savings bank account is not a wise choice.

Technically speaking it’s not a choice which one makes; it is actually that a person does not want to take any kind of initiative by himself.

Further Reading: SIP Calculator

I am pretty much sure that most of you have heard about mutual funds and SIP’s but very few have taken a step towards knowing what these exactly are and why is it good to invest in mutual funds.

Before we jump directly into the benefits offered by SIP, let’s first understand what SIP exactly is. To give you a view of this, I would like to quote an example here:

Most of us had a piggy bank when we used to be a kid and as a kid, we used to put money in that piggy bank every day or every month in a hope that one day we will get a big amount out of it. In the same manner SIP works, we can contribute a little amount for as low as Rs 500 every month in any particular mutual fund scheme for creating huge wealth over a period of time. Now I hope most of you have got a fair idea about SIP.

Proceeding further, now we are going to talk about the benefits of SIP and why one should invest through SIP in mutual funds.

GOOD REASONS TO START A SIP LICIOUS

1. Rupee cost averaging

SIP is one of the best ways to invest in mutual funds. It helps you to average your investment cost. You might be aware of the fact that equity markets are volatile in nature.

They do not move in a straight upward line thereby giving only positive returns. They go through many crest and troughs and hence when the markets are down more units will be purchased with the same amount of investment.

|

MONTHS |

SIP AMOUNT |

NAV |

UNITS PURCHASED |

|

JAN |

10000 |

30 |

333.3 |

|

FEB |

10000 |

26 |

384.6 |

|

MAR |

10000 |

27 |

370.4 |

|

APR |

10000 |

23 |

434.8 |

|

MAY |

10000 |

22 |

454.5 |

|

JUN |

10000 |

25 |

400.0 |

|

JUL |

10000 |

27 |

370.4 |

|

|

|

|

|

|

|

AVG COST |

25.7 |

2748.0 |

So, as you can see that the average cost of your investment comes out to be 25.7. If you would have invested all the money in the first month itself, then your cost of investment would have been 30 which means that you would have got lesser units. Through SIP, the average rate comes to Rs. 25.70 per unit.

Also Read: How can a salaried individual save taxes on their income?

2. Imbibe discipline

There is only one thing which restricts an investor from earning superior returns is his own discipline. Most of us tend to procrastinate things for tomorrow. And our investment behaviour is no different. So, here comes the role of SIP. SIP is the only best way that inculcates discipline in the investor as every month a specified amount is invested in the selected mutual fund scheme automatically.

SIP’s generally come in handy when the markets are volatile because this is the only time period when the investors earn an extra number of units.

3. Power of compounding

The returns generated in case of SIP are compounding in nature. What this means is that the returns in the following year are earned on the previous year’s investment plus previous year’s returns.

Compounding helps in proliferating one’s wealth and this is the reason why it is considered as the eighth wonder of the world.

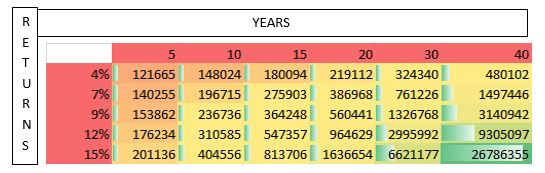

Have a look at the following table, and you will get an idea that how much an amount of Rs 1 lac can grow in different time periods.

4. Small investment

If you think that investing money is not easy and requires a huge sum of money, then you are wrong. Investing money was never so easy, as it is now, as nowadays you can invest for as low as Rs 500 in any mutual fund scheme through SIP.

This has enabled even small investors to invest a certain amount of money for fulfilment of their big goals.

Small investment

Further Reading: Mutual Fund Sahi hai

5. Helps to achieve one’s financial goals

We all have some dreams, and we all want to accomplish them too. But we generally skip the right path which can really help us in achieving our dreams.

The right path which I am referring to is the path of investment. SIP is the best mode of planning and achieving one’s financial goals.

An individual will be able to achieve his goals without putting much burden on his monthly expenses through small systematic investments.

6. Flexible

SIP is flexible in nature in the sense that an individual can start and stop it anytime they want. Also an investor can choose the frequency himself – weekly, monthly, quarterly, etc along with the date of his own choice.

Also nowadays, various fund houses are providing an option to the investors to pause their SIP’s for a certain period of time.

7. Control discretionary expenses

In the current era of e-commerce and the loads of offers they brought along with them have made the individuals shell out more of their pockets.

Due to their excellent marketing tactics, we fall prey to them and end up buying goods which we do not even need.

SIP’s come in handy as it helps an individual in reducing these discretionary expenses. Now you will be wondering how? Well, it is quite easy; just initiate a SIP with a date by which you probably receive your salary.

For example, if you receive your salary by 7th of every month then initiate a SIP with a date not more than 10th. So, now you won’t be left with an extra amount in your bank account which you can spend on less important things.

Also Read: Is it advisable to invest in capital gain bonds u/s 54 EC to save tax on capital gains?

8. SIP Diversifies Risk

The money you are putting into a particular scheme is managed by professional fund managers and they take care of the portfolios overall risk very well by spreading the investment across various assets.

Moreover, with SIP you are able to capitalize on the volatility of the markets.

9. SIP is a Convenient Option

Starting a SIP is much more convenient than investing in any other instruments. You just have to fill all your details once and select the schemes in which you want to invest.

A certain chosen amount will be automatically invested from your bank account every month. And hence you do not have to give instructions again and again.

10. No need to time the market

Every investor on the Dalal street (stock market) tries to time the market in order to accelerate his gains.

However, most of them end up losing their hard-earned money. Remember, no one knows the markets better than the market itself. And hence one should never try to time the market.

And this is where SIP plays its role very well.

The investor is relieved from timing the market as SIP will be processed on a predefined date every month without bothering investors.

Further Reading: Money Control