Systematic Withdrawal Plan or SWP is nothing but a facility that allows an investor to withdraw a fixed amount on a specific date decided by him, from a particular mutual fund scheme.

This facility is specifically beneficial for retirees who are seeking a regular source of income. SWP eliminates the need to withdraw a certain sum again and again.

Further Reading: Best Retirement Plans

Now, you might be thinking how do SWP works?

It is actually quite simple, you just have to decide the amount. And date on which you want to receive your money and have to give instructions to the respective AMC for initiating SWP.

An individual can park his corpus received in the form of PF, gratuity, etc. in a mutual fund scheme and can initiate SWP.

SWP serves the purpose of pension for the retired person as it ensures regular disbursal of a certain amount as decided and required by the investor.

BENEFITS OF SWP:

-

Better Averaging

In SWP, income is provided by redeeming units from a particular mutual fund scheme in which the investors park their retirement corpus.

As we are aware of the fact that markets do not move in a straight line which in turn leads to better averaging in the sense, that if the NAV of a fund increases then to provide the same monthly income, fewer units will be redeemed and vice versa.

Also Read: Investing in Mutual Funds – How to get started with investment?

-

Tax-Efficient

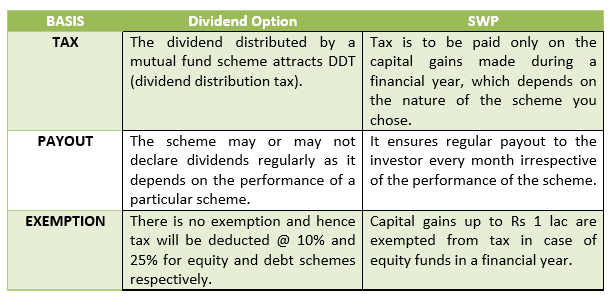

SWP is a tax-efficient tool as tax is to be paid only on the capital gains earned during a financial year. Also if the funds are parked in an equity-oriented scheme then 1 year onwards, the capital gains up to Rs 100000 will be tax exempted.

And if the corpus is parked in a debt scheme then after a period of 3 years, capital gains will be taxed @20% after indexation which however is still lower tax rate for the individual falling in the highest tax bracket.

-

Consistent income

SWP ensures regular income flow to the investor irrespective of the market movements.

The investor gets a fixed monthly income on a fixed date both of which are to be decided by the investor only.

Further Reading: Mutual Funds Sahi hai

HOW SWP IS BETTER THAN OTHER OPTIONS?

-

DIVIDEND OPTIONS IN MUTUAL FUNDS

One may think of opting dividend option offered by mutual funds. However, it suffers from various limitations which are not there in SWP. These limitations are:-

-

PENSION

Most of the individuals especially government employees, receive a monthly pension in their retirement days. However, for those who are not receiving pension may choose the SWP mode for fulfilling their monthly income requirement.

Let us now compare how SWP score more than the pension.

-

TAX OUTGO –

The monthly pension is fully taxable in the hands of the retiree as and when it is received, however, if you choose the SWP route then tax is to be paid only on the capital gains which again will depend on the nature of the scheme in which you have parked your funds.

Also Read: Debt mutual funds – Are debt mutual funds risky?

-

FLEXIBILITY –

SWP has an edge over pension in the sense that it allows an investor to withdraw even a lump sum amount whenever needed which is not possible in case of pension schemes like NPS. In the case of SWP, the investor can choose the date as well as the frequency on his own. Also, one can modify the SWP amount anytime based on his requirements.

-

FIXED DEPOSITS

Most of the retirees’ park their whole retirement corpus in the FD’s. And fulfil their monthly requirements through the interest income received from FD.

However, it is not an optimal way of fulfilling your monthly needs as it is not a tax-friendly instrument. A person in the highest tax bracket has to pay tax @30% on the interest earned.

And also the bank will deduct TDS if the interest income is more than Rs 50,000 in a financial year. While on the other hand SWP is more tax-friendly and provide a hassle-free experience to the investors.

CONCLUSION

One can always resort to SWP for fulfilling one’s retirement needs as it paves the way for better retirement planning which equips the investor with assured monthly income.

And also provide better tax management which ultimately leads to the growth of your money and peace of mind.

Further Reading: Miraeassetmf