Amount Receivable in future (₹)

Time Period

Return Rate

Present value of future income (₹)

₹ 4,000

Present Value (₹ 80,000)

Amount Receivable in future (₹ 100,000)

You must be aware that you would need to ascertain the current value of the amount. Knowing the amount is not enough, but knowing what is the worth of it today is also equally important.

For you to a make better and efficient decision, knowing the present value will help you to make an apple-apple comparison. Being realistic when it comes to money matters plays a crucial role in getting the expected investment outcome.

Present value means the current value of the future sum of money or cash flows with a specific rate of returns and time. Future cash flows are generally discounted at a discount rate. Higher is the discount rate, lower is the present value of the future cash flows. The only key to properly evaluate the future value is to ascertain the appropriate discount rate.

Present value is the idea which says that the value of an amount today is worth more than the same amount in the future. For instance, if you receive ₹ 10,000 today, it will be more than receiving ₹ 10,000 after five years from now. The fluctuation in the money value depends upon three factors: interest rate, purchasing power, and inflation. The present value factor calculator helps the investor to determine the value efficiently without any hassles.

The net present value calculator helps the investor calculate the present value by just inserting the time period and rate of inflation. The purchasing power of your money always decreases over a period of time due to the inflation factor and increases with deflation. As we are aware of the fluctuations in the value of money, we must make proper calculations with respect to any relative future payments or investments.

The net present value calculation is considered to be a standard and efficient way for any investment purpose. Various businesses use the smart method to plan their finances in the most realistic manner. Also, the best wealth builders follow the same method to claim maximum returns from the investments. The basic formula to calculate the present value is:

Present Value (PV) = Future Value / (1+r)^n

Where,

Present Value (PV) = it is also known as discounted value and is the value on a given date of payment;

Future Value = the value which is the projected amount in the future;

r = Periodic rate of return, rate of interest or inflation, also called discounting rate;

n = Number of years.

The above formula determines the present value by taking into consideration the inflation rate. Whereas, the present value of annuity calculator computes the series of cash flows to be received in the future.

The steps involved in determining the present value are designed in a way which can be accessed by every class of society. The ease of calculation can be experienced at single use of the calculator which does not require any set of specific skills. Below are the steps described in detail that can be followed for ease of the calculation?

Present Value: The income receivable in future tab here means the amount that you expect to receive in the future over a specific period of time. This can be any amount which can be determined based on your goal for the particular investment. The goal-based investment system has proved to be beneficial since its introduction, where the investor has a clear idea about the amount and purpose of the investment.

Time Period: The time period is the number of years that you intend to plan the investment for. This factor depends on the goal of the investment. For instance, if you are planning your retirement and your current age is 30 years, the time period, in this case, will be 30 years.

Return Rate: Also known as the rate of return, this can be determined by the current rate of inflation or by considering the historical rates.

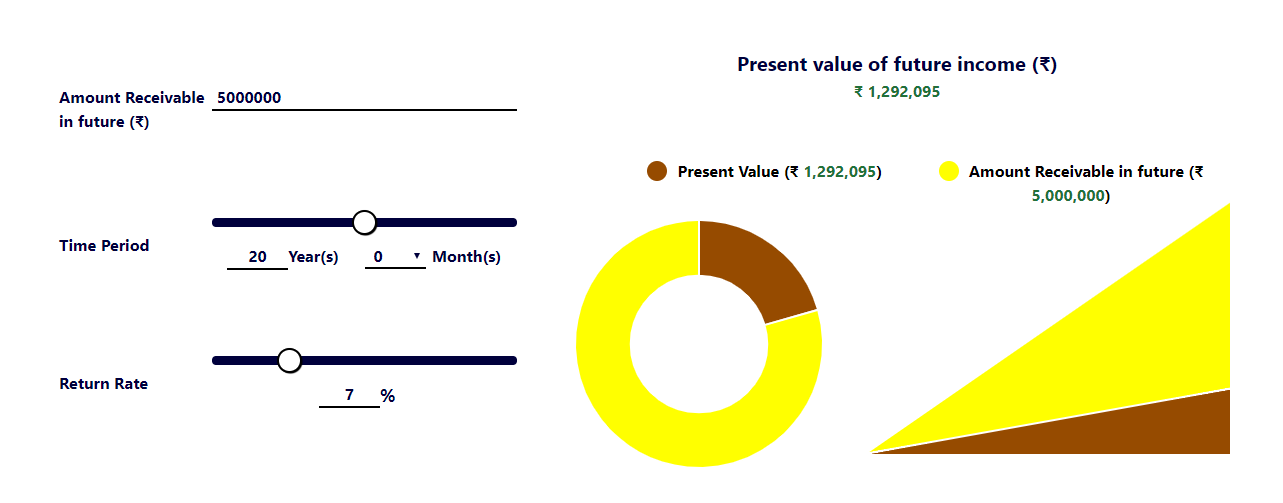

The above screenshot gives us the present value investments where,

Future Value = ₹ 50,00,000

Time Period = 20 years

Rate of return = 7%

The present value of investment required for the future value of ₹ 50 lakhs is ₹ 12,92,095. The present value calculator is a process of determining the current value of money without adding timely interest received on investments whereas, the present value calculator compounded adds the timely interest received on investments and then calculates the present value.

We all have ambitions in our lives. These ambitions are always connected with money, whether it is buying a dream house, your child’s education or retirement planning. If you don’t have any such plan or ambition, you are doing it wrong. Securing our future or planning our finances to achieve the goals should always be the priority for a financially stable life.

Even if you are saving, your biggest concern would be “how much to save or how much money would you need and when.” In such a case, it’s better if you seek help from a professional. Basically, the present value concept helps the investor to know the current value of the money he or she would like to have in the future. When we connect this concept with goal-setting, it becomes a lot easier to invest as the investor is aware of the purpose behind it.

Determining the present value of the future amount helps the investor to invest the exact amount and get the desired results. There is a simple procedure that will help you to plan your finances smartly. Below are some steps that can be followed are:

• List your major life goals

• Give them a priority;

• Segregate them as Needs or Wishes;

• Rank them based-on priority;

• Calculate the future value using the future value calculator; or/and

• Calculate the present value using the present value factor calculator;

• Prepare an investment plan or seek help from a professional.

The first step in planning your finances is to know about your life and financial goals. Once these are determined, the present value calculator will help you to invest the exact amount and claim the desired outcome.

For an investor, the first step is to know the life goals and then plan the finances accordingly. The present value calculator helps the investor in determining the exact amount to be invested now. However, while planning and determining present value, it is crucial to consider the realistic inflation rate. If not, the entire calculation can misguide you and attainment of the goal may become unrealistic.

Let’s understand the concept of present value for goal attainment with an example. You want to buy a dream shop which costs ₹ 100,000 which you will be able to earn in the next 5 years. Doesn’t this sound good, you will be able to make the entire money in the next 5 years.

But it is not true. The future stream of money would not be equal to today’s ₹ 100,000; they would be worth less. The value falls due to the inflation factor and in order to find the exact value, you can use the present value calculator using a discount rate.

Let’s assume that the present value calculation shows that ₹ 100,000 future earnings actually equal ₹ 85,000 today. The present value of the future cash flows is ₹ 20,000, which is less than your original investment. In this case, you might not want to invest ₹ 100,000 in the shop as the future value is less than what was expected. Hence, the present value helps the investor in analysing the future value of the goals and decides whether the investment would be worth the time and money.

The present value calculator serves as a crucial help to the investors and offers various benefits which are:

• The investor can know the exact current amount and value of the investment;

• Helps the investor to decide whether the investment will be worth his or her time and money;

• The investor can achieve his or her goals efficiently by goal-setting concept;

Q1. Is there any particular tenure to determine PV?

A. No, you can decide the number of years based on your goal or investment plan.

Q2. What rate of inflation can I consider to calculate the PV?

A. The ideal inflation rate should be the current rate or the historical rate which can be accessed from RBI’s website.

Q3. How to determine the FV?

A. You can simply decide your goal for the investment and calculate the FV by using the future value calculator. Or if you think that you will need a particular amount in the future, you can put the same figure in the present value calculator.

Q4. What is Net Present Value (NPV)?

A. NPV is a series of future cash flows receivable in future discounted at a particular discount rate for the calculation of present value.

Q5. How can I do a goal-setting?

A. Goal setting can be done by listing your life goals and setting them on priority. You can find the present value of each of them and start investing based on priority.

If you still have any other questions/ queries in mind, do not hesitate in contacting us.

8AM - 8PM (Mon - Sat)