Present Cost (₹)

Time Period

Inflation Rate

Future Amount Required (₹)

₹ 100,000

Present Cost (₹ 30,000)

Future Amount Required (₹ 100,000)

We, as human beings, have unlimited wants throughout our lives. However, we have never seen our future and what lies ahead. If we plan our finances ahead, it may help us in a rough phase of our life and help achieve our goals efficiently.

Finance is a wide area which can also help us in determining the present and future value of money to plan accordingly. Similarly, future cost calculator helps us to determine the future value of money by taking into account the inflation rate. Once we determine the future value, it becomes easy to save and invest over the time horizon.

Mutual fund advisors are busy pitching goal-based funds to attract the investors. The goal-based system has shown a positive trend as the investors understand the importance of relevance to their goals. However, investors pick up a big figure for their future say 50 lakhs or 1 crore, which they think would be enough. But, what seems big now may not hold the same value in the future. Here comes the role of future-cost calculator which calculates the value by considering inflation and gives nearly exact future value.

The value of currency may fall or rise in the future with respect to the inflation rate. It does not remain equal within two points of time. The basic principle of investment says that current purchasing power will have less purchasing power in the future but purchasing power increases with the investment returns. The future cost calculator uses the below formula to reach a future value of current purchasing power.

Future Value (FV) = Present Value (PV) * (1 + Rate of Return) ^ Number of Years

The future cost calculator formula may look complicated but makes the math easy not just for future value calculation but also allows investors to take into account recurring deposits, taxes, and annual interest rates.

The future cost calculator computes the value by just inputting figures such as present cost, time period, and inflation rate.

The steps included in determining the future cost calculator are easy that needs no specific skills to operate. It is designed in a way that a layman can understand and secure his or her future. Below are the steps that are involved in the future value calculator India.

Present Cost: The present cost means the present amount that you would like to claim in the future. Determining the appropriate present cost is the key to evaluate future value properly. However, while determining the present cost you should consider some aspects such as standard of living, purchasing power, and expenses. When these factors are considered, the risk of lowering your standard of living due to inappropriate planning for future reduces to a large extent.

Time Period: Determining the number of years or time of your investment is the key step. The figure depends upon the goal of your investment. Say for instance, you are planning your retirement and your current age is 30 years and retirement age is 60 years. Your time period, in this case, can be 30 years.

Inflation Rate: The rate of inflation is the expected rate in the coming years. The inflation rate can also be calculated by considering the historic consumer price index and then converting it into a percentage. In future value calculator, inflation can be assumed on the basis of historical rates.

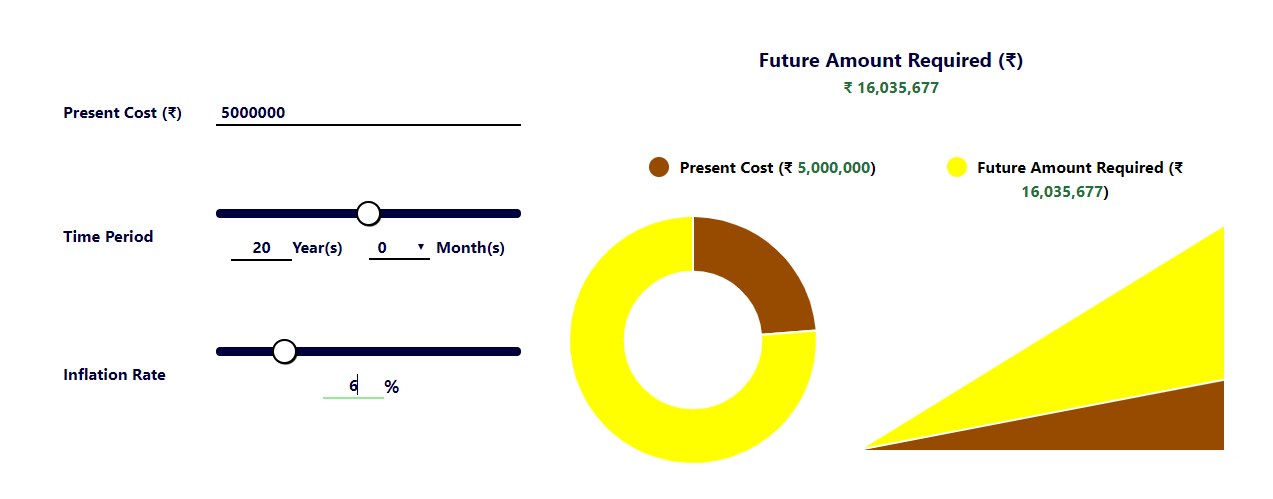

The above image shows the calculation by considering the following figures:

PV: ₹ 50,00,000; Time Period: 20 years; Inflation Rate: 6%

The future value in the above case comes to ₹ 1,60,35,677 which can be further planned and invested.

In the fast-growing Indian economy, factors such as inflation have made it mandatory to invest in various plans. The current trend in the Indian economy is earning as much as one could and the savings are invested for the future. But, the investment rule says that one size doesn’t fit all. Hence, the investment should be made depending on your purpose which can be one hundred cents beneficial.

The future cost is the value of money that you will need to accomplish a particular goal. The proper ascertaining of this value helps the individuals in breaking-up the amount and saving in small parts rather than bulk savings or investments. The small chunks are always better than investing high amounts and this is what future value calculator does. The compound interest calculator helps the investor to determine the growth of your money with regular deposits or withdrawals. The future value compound interest calculator has an additional factor of periodic deposits that the investor can make and calculates the future value accordingly.

The future value calculator helps the individuals to plan according to their particular goals which might vary from time to time. The investor can come up with the future value amount by using the calculator and further divide it by the number of months to reach the monthly investments to be made by the individual.

For instance, for my goal is to provide my child with the best higher education, the future value of the expenses comes to ₹ 50 lakhs. I would like to invest on a monthly basis and it would take 20 years for my child to pursue her higher education. Hence, I will have to invest ₹ 20,835 (5000000 / 12*20) per month to reach the desired goal. You will earn interest over and above this amount. If I plan this way, I will save myself from last minute tensions of huge fees and my child’s future.

Hence, this way the present value calculator and future value calculator help the individuals to plan for their future goals in the most efficient manner.

The use of future cost calculator has numerous benefits which can be claimed by each one of us. These benefits are as below:

• The user can determine the accurate value of the investment which can be done through SIP or lump-sum investment mode.

• User can calculate the returns accurately and can achieve their goals efficiently.

• Plan the number of deposits depending on the returns and their preferences.

• Make an investment plan that would suit the investor’s budget and requirements.

• The sliders can be adjusted according to get the exact amount of returns from the investments.

• The investor can calculate the cost of taxes.

• The investor can efficiently calculate the future purchasing power based on the inflation rates.

• Saves your time for complex calculations.

• You will be free from any last minutes tensions regarding your goals as you are already prepared for the same through your systematic savings.

The present value is the value of your money today. The present value calculator computes the value when you’re sure of the figure you want in the future or it computes backward when compared to the future value calculator. For instance, if you have ₹ 50,000 in your bank account today, the present value is ₹ 50,000. If you keep ₹ 50,000 in your wallet, it will earn no interest and the future value will decline making ₹ 50,000 in the future worth less than what it is today.

Similarly, if you invest ₹ 50,000 in an economy where inflation doesn’t exist, then the future value will rise with reference to the rate of interest and taxes (₹ 50,000 + Interest – Taxes).

Inflation is when there is a general rise in the prices or when the purchasing power reduces over a period of time. It is a quantitative measure in which the average price level in the economy increases over a period of time. As the prices increases, the single unit of currency loses its value leading to buying lesser goods or services. The loss of a single unit of currency reduces the purchasing power of the individuals leading to a deceleration in economic growth.

For instance, if you plan your child’s higher education after 15 years and the present value of the course is ₹ 5 lakhs. Assuming that your child will go to college after 15 years, you need to find out how much will the cost get inflated after 15 years. Putting these figures and assuming the inflation rate to be 9%, the same education will cost ₹ 18,21,240 after the desired time period. This is how inflation affects the present value by 9%.

Inflation is a result of increased demands of goods and services. As the economy rises, the demand for goods and services also grows leading to inflated prices. The inflation rates are measured by the Consumer Price Index (CPI) which is published monthly. The inflation shrinks savings if not calculated properly. The future value calculator with payments adjusted with inflation helps the investor to determine the series of payment over a period of time.

For instance, you have ₹ 10,000 in your savings account and after a year you will have ₹ 10,100 in your savings account. But the rate of inflation is 2%. Here, you will need ₹ 10,200 to have the same purchasing power that you started with.

Q1. Is the savings calculator and future value calculator the same?

A. No, both the calculators are different from each other.

Q2. What is the right age of investing?

A. Mutual funds do not have any specific age. You can start investing from the day you start earning.

Q3. How can I determine the inflation rate?

A. You can calculate the inflation by CPI method or use historic rates to calculate the future value.

Q4. What is the Future Value?

A. Future value is the amount which includes inflation also together with present value.

Q5. How can I get the present value?

A. You can research the present value of your goal easily. For instance, if it’s your child education you can ascertain the current fees and educational cost.

If you still have any other questions/ queries in mind, do not hesitate in contacting us.

8AM - 8PM (Mon - Sat)