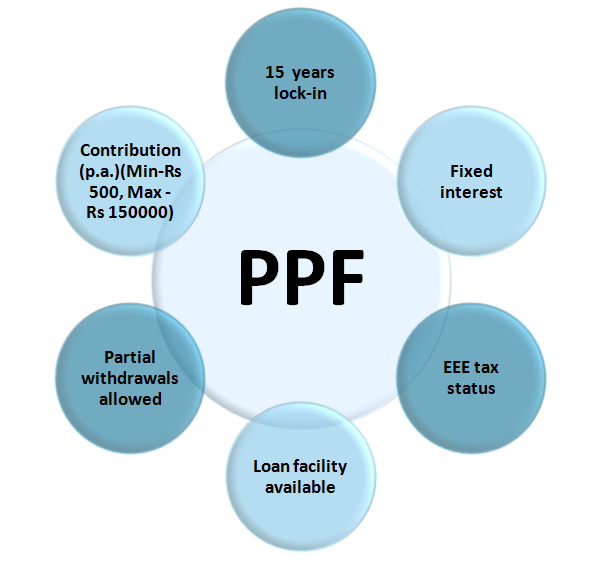

PPF or Public Provident Fund is a government sponsored long term savings scheme which bears a fixed rate of interest which is decided at the end of every quarter.

It was initially started to provide retirement security to the self employed individuals as well as those who are working in unorganized sector.

PPF account is open for subscription to all the Indian nationals and is one of the most preferred investment options of the Indian citizens as it enjoys EEE tax status. One has to invest a minimum amount of Rs 500 every financial year in order to keep PPF account active.

Further Reading: Best Pension Plans

Also, the maximum amount that can be invested in a financial year is capped at 1.5 lacs. The lock in period in case of PPF is 15 years, however, one can avail loan facility or can withdraw some amount even before maturity. In this blog, we have tried putting all the necessary information that an individual should know about PPF.

HOW TO OPEN A PPF ACCOUNT

HOW TO OPEN A PPF ACCOUNT

In order to open a PPF account, one can either visit the nearest bank branch or post office and submit the form along with necessary documents. Now, one can even apply for PPF account online. However, one has to submit necessary documents along with the form filled online in the branch where you want to open your PPF account. A passbook will be issued once the account is opened.

Documents Required

- Form 1 (PPF account opening form)

- Identity Proof like Aadhar, voter ID, etc

- Address Proof like Aadhar, utility bills, etc

- PAN card

- Passport size photographs

CONTRIBUTION

The minimum and maximum amount of contribution is Rs 500 and Rs 1,50,000 respectively. The investor is allowed to make a contribution in multiples of Rs 50, and can invest either in lump sum or instalments. The maximum investment limit of Rs. 1,50,000 is inclusive of the deposits made by the holder in his own account as well as in the account opened in the name of a minor child. Earlier an investor was allowed to make only 12 contributions in a financial year but now there is no upper cap on the number of deposits that can be made in a financial year.

In case a subscriber did not make any contribution in any financial year, then his account will become inactive. One has to pay a penalty of Rs 50 along with the arrear subscription of Rs 500 for each year of default in order to reactivate the PPF account.

Also Read: Traditional schemes: Is investing in traditional schemes like PPF, SSY, etc still makes sense?

ELIGIBILITY FOR PPF

- A PPF account can be opened by any individual who is a resident of India. The account can also be opened in the name of the minor. However, only one PPF account can be maintained by an individual except an account that is opened in the name of the minor.

- Both the parents cannot open a PPF account in the name of the same daughter or son.

- Also, grandparents are not allowed to open a PPF account in the name of their minor grandchild, however in case of death of both the mother and father of the child, PPF account can be opened by them.

- NRIs (Non-resident Individuals) cannot open a PPF account. But if a resident subsequently becomes NRI then he can continue with his PPF account.

Note: – An individual is not allowed to operate more than one PPF account. But if in case he holds more than one PPF account then deposits made towards this other account will not earn any interest.

INTEREST ON PPF

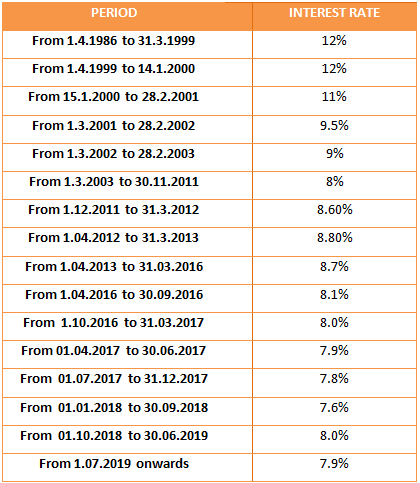

Interest on PPF account is compounded annually however, it is calculated every month. The main reason behind this is that any contribution made by you before 5th of every month will earn interest for the whole month. While any amount deposited after 5th will not earn any interest for the entire month. For example, if you have invested on 3rd May, then you will earn interest for the month of May while if you invest on 6th May, then you will not earn any interest for the month of May.

Interest rate on PPF account has undergone a significant change over a period. Following is the list of interest across various periods.

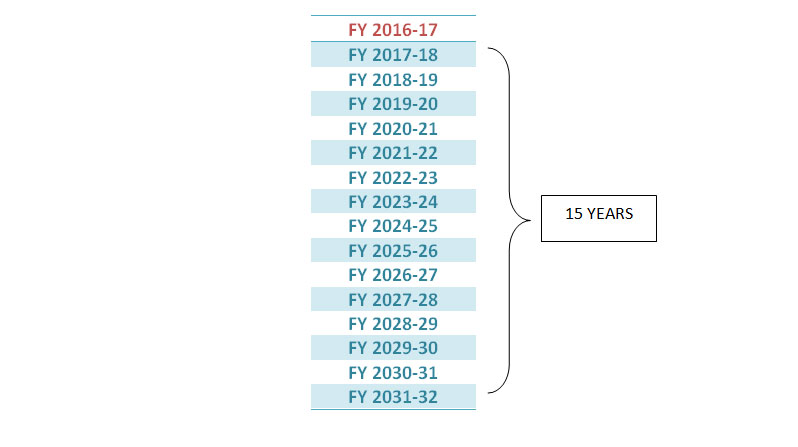

LOCK-IN PERIOD IN CASE OF PPF

The lock-in period in case of PPF account is of 15 complete financial years. What this means is that if a subscriber opens a PPF account on 1st April, 2016 then the PPF account will mature only on 31st March 2032. Even though the account was opened on the first day of the financial year, but for the calculation of years FY 2017-18 will be considered as the starting point (1st year) as in PPF the number of years is calculated from the end of the financial year in which the account was opened.

WITHDRAWAL

- On or after maturity

After a lock-in period of 15 years, the PPF account holder can withdraw the entire amount by submitting Form-3. Also, no tax is to be paid on this amount. However, a person may opt for an extension of his PPF account with or without making any contribution towards his PPF account.

One has to submit Form 4 along with the necessary documents before the expiry of 1 year from the date of maturity if the account holder wants to extend his PPF account and want to continue making deposits in his PPF account.

- Extension with contribution

Extension of PPF account with contribution is allowed only in the blocks of five years. Once the extension request has been made, the investor will not have an option to withdraw it at a later stage. However, if the account has been continued for one or more block periods, the account holder has the option to leave the account without making any further deposits on completion of any block period.

In case of extension with a contribution, PPF account holder is allowed to withdraw only 60% of the balance (at credit at the beginning/commencement of the block period) during the extended block period i.e. 5 years.

- Extension without contribution

PPF account holder can choose to retain his account for any period without making any further deposits in his PPF account. The entire balance at the investor’s credit will continue to earn returns at the prevailing rates. There is as such no restriction on the investors with respect to withdrawals. They can withdraw any amount but only once in a financial year and the balance will continue to earn interest until it is withdrawn.

NOTE: – Once an account is continued without deposits for more than a year then the account holder will not have an option to continue the account with deposits in any case.

Further Reading: Value Search Online

- Before maturity

An investor is allowed to make partial withdrawals from 7th financial year onwards from the year of opening of PPF account. For example, if you have opened a PPF account in FY 2019-20 then you are allowed to make withdrawals from FY 2025-26. The maximum amount that can be withdrawn before maturity is the lower of the below-mentioned conditions:-

- 50% of the balance at the 4th year immediately preceding the year of withdrawal. For example, if the withdrawal request is placed in the FY 2019-20, then 50% of the balance at the end of the FY 2015-16 is withdrawable.

- 50% of the balance at the end of the year immediately preceding the year of withdrawal. . For example, if the withdrawal request is placed in the FY 2019-20, then 50% of the balance at the end of the FY 2018-19 is withdrawable.

Provided that the whole amount of loan outstanding along with interest has been duly paid and the account has not become discontinued. This facility can be availed only once in a year.

- Premature Account Closure

An investor can withdraw his/her PPF investments before maturity upon submitting Form-5, on any of the following grounds: –

- The amount is required for the treatment of serious ailments or life threatening diseases of the account holder, spouse or dependent children or parents, on production of supporting documents from medical authority.

- The amount is required for the higher education of the account holder or minor account holder on production of documents and fee bills confirming admission in a recognized institute in India or Abroad.

- In case of any change in the residency status of the account holder on production of a copy of Passport or visa or Income tax return

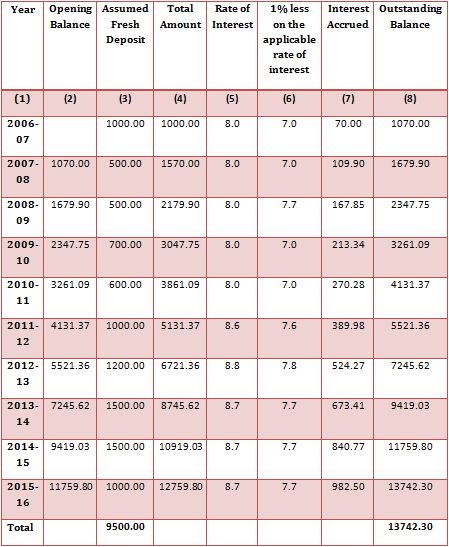

Provided that the PPF account has completed five years from the end of the year in which the account was opened. There is one more important thing to note that the premature closure of PPF account is subject to a penalty of 1% on the interest earned previously from time to time.

The below-mentioned table shows the working of premature complete withdrawal/closure:

NOMINATION AND REPAYMENT ON DEATH

- The subscriber may appoint nominees by filling Form 1 who will receive the amount standing to his credit in case of his death.

- No nomination can be made in case the account is opened in the name of the minor.

- In case the nominee is a minor, the subscriber may appoint a person who will receive the amount due under the account in the event of the death of the subscriber.

LOAN FACILITY

One can avail loan against his PPF account from 3rd financial year up to 6th financial year from the year in which the initial deposit was made. For example, if you have opened a PPF account in April 2016 then you can apply for a loan from the financial year 2018-19 up to 2022-2022.

Also, the maximum amount of loan that can be availed is restricted to 25% of the balance at the end of 2nd financial year immediately preceding the year in which the loan was applied for.

For example, if you have applied for a loan in FY 2018-19, then you can avail 25% of the balance available on 31st Mar 2017 as loan.

The subscriber of the PPF account has to submit Form 2 for obtaining a loan against PPF account balance.

Loan repayment and interest-

The principal amount must be repaid within the period of not more than thirty-six months from the first day of the month following the month in which the loan is sanctioned. The principal amount can be paid either in one lump sum or two or more monthly instalments within the prescribed period of thirty-six months. Once the principal amount is repaid, then the interest is to be paid in not more than two monthly instalments.

The interest payable on the loan against PPF account is 1% per annum higher than the prevailing interest rate on PPF. For example, if the prevailing interest rate on PPF is 8%, then one is liable to pay 9% in interest on the loan availed against one’s PPF account. Interest is payable for the period commencing from first day of the month following the month in which the loan is drawn upto the last day of the month in which the last instalment is repaid. For example, if the loan is sanctioned on 15th Mar, 2016, and principal is repaid till 25th Mar, 2020 then one has to pay interest on the outstanding amount for the entire period from 1st Apr, 2016 till 31st Mar, 2020.

Also, if the principal is not repaid or only a part of loan is repaid within the stipulated time period, then the interest on the outstanding loan is to be repaid at the rate of 6% p.a. instead of 1% p.a.

Further Reading: Mutual Fund Sahi Hai

TAX BENEFITS

PPF enjoys EEE (exempt- exempt – exempt) tax status which means that the contribution towards PPF account, accruing interest and the maturity value of the corpus is exempted from tax. Any contribution made towards PPF account is eligible for deduction u/s 80C of the Income Tax Act, 1961. This is the reason why PPF is one of the sweet spots for investment.

CONCLUSION

Talking from the financial planning point of view, you can invest in PPF if you are okay with the low returns and want to avail tax deductions and earn tax-free income only. However, if you want to grow your wealth along with saving taxes then you will be better off by choosing ELSS mutual fund schemes as your wealth partner.